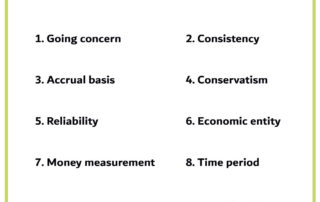

8 Accounting Assumptions Every Accountant Should Know

When it comes to preparing a financial report for any organisation or firm, there are some theoretical assumptions that all accountants must follow. Accounting assumptions are very important for laying the foundation of consistency so that they can be used for assessing the reliability of the financial documents of a business firm while ensuring that the financial health is described therein. 8 Accounting Assumptions That Help in Business Attribution: The icons has been designed using resources from Flaticon.com Going concern With this assumption, accountants assume that a business should ensure ...Read More