To keep the financial aspect of our life under control, we have to keep track of our financial transactions. When it comes to business, the financial statements are the standard way to record and track your financial situation, performance, and money decisions. The main types of financial statements are the income statement, the balance sheet and the cash flow statement which are the three main statements required to be prepared by any business.

To keep it short, balance sheet is used to record your financial position/situation. The Income statement presents your business performance. And cash flow statement explains how you take decisions with your money.

We will go now into more details on the main 3 types of financial statements.

Balance Sheet

The balance sheet is usually the first statement to be prepared. It is the document where the business will record everything they own to track their net worth.

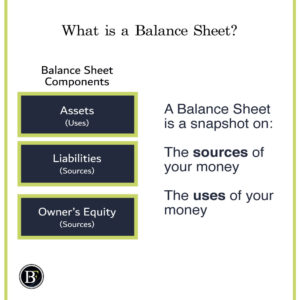

A balance sheet is a snapshot on the sources of your money and how you used your money as of that moment. That is why they also refer to it as statement of financial position because it tells you what is your financial situation.

Let us have an example, John decided to open a store where he will sell PCs and Macs. To start the business, he did the following:

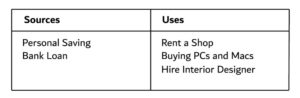

To raise money he:

- Deposited from his personal savings

- Took a loan from the bank

He spends the money on:

- Renting a shop

- Buying the PCs and Macs

- Hiring an interior designer who handled the design and furnishing

At the end of the week John started working on recording his business current financial position. Let us fill the sources and uses table for him.

In general the above is the basic level of a balance sheet. But in realty there are many more line items to include which made accountants categorise the balance sheet differently by including assets, liabilities and owner’s equity.

Basically, the assets are the uses and the liabilities and owner’s equity are the sources. Let us have a look at them in general.

Assets (Uses):

The value of what you own like cash and equipment, or what you are supposed to own like cash that was not paid to you yet for example the account receivable.

Liabilities and Capital (Sources):

Are the value of what you owe. If it is a liability then it is owed to a bank if it is owner’s equity it is owed to one of the business owners.

You may wonder why did they make two categories for liability and capital. The answer is because it is important to know how much the business really owes (from liability) because its not their money. When it comes to owners money it can be less crucial because it is their own money (from owner’s equity).

If John gets out of business, he is legally obliged to pay his creditors first (from liability) and then the remaining money can be distributed to him (from owner’s equity).

We discussed the sources and uses, but if you notice when John hired the interior designer he can’t use/own the designer forever.

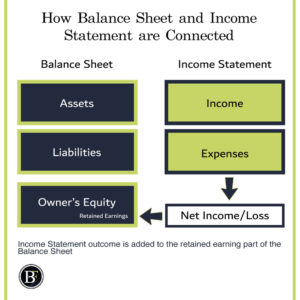

Spending money and also income that are not related to the sources and uses are considered as retained earnings/loss which are used under the owner’s equity.

The retained earning is basically the accumulated profits or losses from income statement over the years. It is the connection between the income statement and balance sheet.

Income statements

Now John started receiving income and also did some spending (can be called expenses too). These two items are the ones influencing the retained earning in the balance sheet and are the main components of the income statement.

Income statement not only add-up to the balance sheet. The income statement also used as a performance measure of the overall income and expenses of a business for a specified period.

Unlike the balance sheet which is a snapshot, the income statement is like video recording. There is a timing challenge when recording the transactions. let us have an example to know why.

John decided to pay the rent for two years in advance. Would it make sense that he records all the spending in year one and exclude them from the second year? The answer is no, otherwise their wont be good measurement of the performance if he wants to compare the two years.

That is why accountants prepare income statement on accrual basis. Which basically make transactions spreads out the income and losses with relevance of their specific timeframe and accounting rules.

The income statement does well as a performance indicator. But the challenge is how can we measure the actual cash movement?

If John paid for two years in advance but in the income statement he incurred it for only one year there will be a gap in the cash movement. Here is where the cash flow statement is important.

Cash flow statement

To help John answer the questions “where did my money go? and how much did I receive?” he will need to start preparing a cash flow statement which describes how the actual cash is moving in the business and out of the business.

The cash flow statement items are categorised into three. Cash flow from operations, cash from investing, cash from financing.

There are two ways to prepare a cash flow statement, the direct method and indirect method.

The direct method is prepared by collecting all the company payments and all the receipts and add it to the sheet. But because a balance sheet and income statement are a common statements to use, the indirect method has become a preferred way to do it.

The indirect method prepared from the net income in the income statement and adjusting the increase or decrease from the balance sheet items.

The indirect method is actually simpler to prepare because of the companies record keeping process. Most businesses would not want to collect all the receipts just to create this statement.

And we are done. Those were brief explanation of the main types of financial statements.

Final Thought

The financial statements arguably could be the single most important topic to understand if you want to be in the financial industry. This post was simplified and just the tip of the iceberg.

If you enjoyed reading about the types of financial statements please let me know if you want me to talk more about it. You can also check out a detailed article from Investopedia where they discussed the history of accounting that I found interesting.

Disclaimer: Above links below are affiliate links and at no additional cost to you, I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful, not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.

Related Posts: