The first financial statement for any business is the balance sheet. When money comes in, owners/banks inject the money and the assets in the business increase. Such statement makes the balance sheet is an indispensable source for business decisions when it comes to allocating resources and funding.

A balance sheet offers insight into a company’s financial status as well as a piece of critical information regarding an entity’s ability to continue to survive and operate its business operations for the foreseeable future.

But the question in this post is what are the limitation of the balance sheet?

In summary, the main limitation in the balance sheet is the valuation of the assets which are influenced by subjective inputs.

Quick Recap: What is a Balance Sheet?

Before we jump to the details, let us have a quick recap. A balance sheet is a combination of sources (liabilities) and uses (assets) of a business at certain point of time. (discussed in more details in this post).

Attribution: The icons has been designed using resources from Flaticon.com

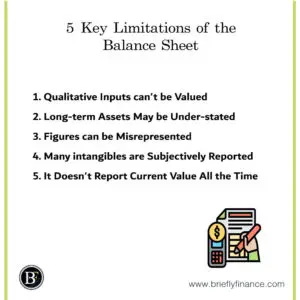

5 Limitations of A Balance Sheet

Like any other financial statement, the balance sheet has various limitations that can hinder effective decision-making. I will share with you our opinion on the 5 limitations of a balance sheet.

-

Qualitative Inputs can’t be Valued

A typical balance sheet can only report those assets that have been obtained through transactions (quantified) thus leaving behind critical qualitative information to subjectivity.

Let us say a company whose most valuable assets is from qualitative inputs such as human intelligence which does not appear on the company’s balance sheet which makes it look less valuable than it really is.

For example, company XYZ has developed an online platform that is currently attracting millions of buyers every day with assets valued in terms of the online platform, warehousing leases, vehicles and equipment, loans, and cash.

However, the main assets that makes the business unique are not quantified, which includes the talented designers, exceptional managerial skills, exceptional content writers, and those who materialised the internet business are not recognised as assets on the balance sheet.

-

Long-term Assets May be Under-stated

Long-term assets are those anticipated to serve in the company for more than a year. They include building, machinery, and land, among others.

A balance sheet typically recognises the value of these assets based on their historical cost. This means that a balance sheet does not report the actual value of a long-term asset at its current value.

There are certain occasions that assets are valued at their current price (fair value) which is when these assets are directly related to the business operations (example a hedge fund that buys and sells their stocks has to fair value their assets).

-

Figures can be Misrepresented

A balance sheet is simply a snapshot of a company’s financial position at a given data. The owners and managers can manipulate such data so that the balance sheet figures look more promising than the company’s actual position.

Misrepresenting a company’s actual position at a particular moment can enable a company to acquire more loans than what the company could have accessed in its actual position.

For instance, a balance sheet with over stated assets values could indicates a strong financial position against solvency risk. misrepresenting the figures could be done in several by wrongfully depreciating the assets or using an inventory accounting methods.

Those misrepresentation techniques can be done legally, and its the analyst job to review it properly and do the proper adjustments. For example, if you want to compare two companies in the same industry, where one of them records their buildings at fair value versus the other records them at historical value, it would be ideal to make them both consistent to ensure that the comparison is properly done.

-

Many intangible Assets are Subjectively Reported

Indeed, you know that a company’s ability to boost its revenue in the future depends on its good image and reputation. It takes resources to build a good business image.

For instance, a startup company can incur a large amount of capital to develop the trustworthy intellectual property to generate sales. At the initial phase the sales may be minimal which can significantly result in underestimating the actual worth of a business even though it incurred huge amounts to establish its brand in the market.

Another example, when a company acquires another company, the difference between the purchase price (cash paid) and the book value (the purchased company total assets – total liabilities) will be shown in the assets side as a goodwill. That figure is based on the judgement of the acquirer and not actual value that an analyst should fully rely on.

-

It Doesn’t Report Current Value of an Item All the Time

It is more reliable in knowing the current market value of the various assets in a company rather than their value at cost. However, a balance sheet doesn’t always show these figures.

For instance, certain properties may be worth a certain amount during the time of purchase but lose their value over the years because of the company use like vehicles and furnitures.

Other items may gain more value like land and properties, but such changes are not reported in the balance sheet, which means that the total asset figures of a company may not be accurate at all times.

General Ideas to Keep in Mind

1. A balance sheet may not contain all the information you need

Are you aware that a balance sheet alone doesn’t contain all the information needed to make an informed decision? You will be required to outsource the missing information from other ancillary sources of information such as the financial statements. For instance, when performing the ratio analysis, you must refer to data found in a different financial statement. Besides, products in the processing phase still add value to a company since developing them generates revenue to the business through sales. A balance sheet doesn’t report all the inventory and products-in process.

2. It is tedious to make comparisons of the various balance sheet information

As a stakeholder, you will have to compare the company’s balance sheet you are interested in with the balance sheet from the company’s competitors for several accounting years to make an informed decision. Sometimes, it can become tedious to compare a large volume of data in the various balance sheet. Besides, it takes other financial statements to compile a balance sheet. For instance, you will need the company’s income statement and also the changes in the equity ownership statement to prepare a balance sheet. This means that a slight mistake, whether intentional or a human err will affect the accuracy of the balance sheet. Besides, any other limitation of other financial statements will also be transferred into the balance sheet. All the financial statements must be used together since failure to do so can easily result in inaccurate information, prone to misinterpretation.

3. Non-financial issues are not included in a balance sheet

We all know that businesses do not run in isolation. For instance, political stability, environmental attractiveness, competition are all non-financial issues, but they significantly affect the performance of a business. A company can report a strong bottom line figure but has poor performance in other non-financial aspects. However, the balance sheet won’t indicate that it had performed poorly on other aspects despite reporting an attractive bottom-line figure. As a stakeholder, you might end up making a wrong decision on your investment if you considered the balance sheet only. Managers cannot include and report external business influences such as the socio-economic circumstances in the balance sheet. Therefore, the figures on the balance sheet may not be an accurate representation of the business based on the external conditions around the business.

Final Thoughts

Despite the fact there were limitations on various items in the balance sheet, particularly the valuation aspect. These limitation still can be overcome with adjustments and that is the fun part when analysing a company.

Most of what the education system teaches us is that how to make a balance sheet as if the figures are fixed. But if you think about it any item can be adjusted. For example, If you check a company notes and know they have 10 Toyotas which were depreciated to $0 after five years it would not make sense to consider those assets to be $0.

Anyway, thank you for reading the post and I hope you benefited and enjoyed the content.

Related Posts:

- 3 Types of Financial Statements Explained

- The 3 Components of the Balance Sheet Explained

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.

[…] 5 Key Limitations of the Balance Sheet […]