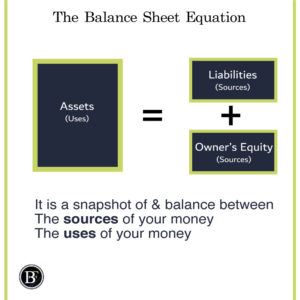

Companies use the balance sheet to keep track of their net worth. The balance sheet is a snapshot of the company sources of the money and how they used the money.

Its components are Assets, Liabilities and Owner’s Equity. below is the formula that represent the balance sheet.

Assets (uses) = Liabilities + Equity (sources)

The balance sheet should always be balanced where the uses (which is what the company own) and the sources (which is from where they get money from) has to be equal.

Why is the Balance Sheet Important?

When it comes to investing or providing a loan the balance sheet is the first place to go to for identifying how financially strong is the company.

It gives a reflection on how much this company own, and whether it can survive in the short and long run.

It is the financial strength indicator of the company. When it is strong there is less chance that the investor would lose all his money.

A good performing company (identified from income statement) may get bankrupt if they did not have a strong balance sheet to pay its obligations.

A balance sheet is also used to analyse the company operations. Does the company always owes banks much? Do they stack inventory unnecessarily? Are they handling the operations flow properly?

Let us have an overview of each balance sheet component. We will have a breakdown of common line items under each component.

Assets

Assets are what you own or in other words it is what resources do you use. Companies will typically keep some of their assets in cash, products they have for sale, and a property for example.

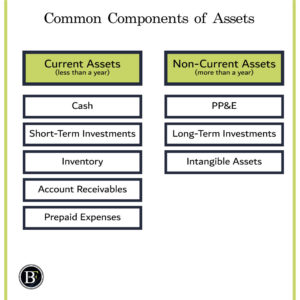

To make reading balance sheets easy accountants have divided the assets into current and non-current assets.

These categorisations are good to help understanding if the company can handle short-term or long-term challenges.

Current Assets

Current assets are what the company own and can convert it to cash within one year.

This category is usually looked at to look at the company ability to pay their short-term loan obligations and how are they dealing with their working operations. Here is a list of the common current assets to clarify.

Cash (also referred to as cash and cash equivalents in certain situations)

It includes the cash the company have and the financial instruments that can be turned into cash with no risk of losing money within 90 days. For example, a short-term treasury bill.

Short-term investments

Short term investments in the other hand are the ones that takes less than a year to liquidate but not less than three months like certificate of deposits for example.

Inventory

Inventory includes the products or material the company has which are related to the end-product that is being sold to their customers. For example, for a company that sells bottled water the plastic will be part of its inventory.

Account receivables

Account receivables is the amount sold on credit. For example, a car showroom owner may sell cars on installments. Account receivables will include the amount they are expecting to receive within one year.

Prepaid Expenses

It consists of the amount that the company pay in advance before receiving any product or service. For example, insurance is paid in advance.

Non-current Assets

Non-current assets are what company own that take longer than a year to convert to cash.

This category can be useful to see if the investor would want to know whether the company analyzed can survive in the long run. And do they have any backup assets to sell in the situation they have to pay a large sum of money?

Property, Plant and Equipment (PP&E)

PP&E includes any assets that are held for a period longer than one year. Like cars, buildings, and office equipment.

Long-Term Investments

Represent the investments the company make for more than a year. It can be real estate and bonds and stocks held for long term

Intangible assets

They are the assets that do not have any physical presence but can contribute to the organisation with returns in the long term.

For example, a patent can protect its inventing company from being copied by competitors for a typical period of 20 years. This allows them to generate income for their efforts for certain applicable time.

Liabilities

The liabilities are the items explaining what the company owe. To fund any company there are two ways, either with loans or with owners’ cash. The liability refers to the loans part.

You may wonder, why don’t companies just use the owner’s money? Isn’t dealing with banks riskier? The answer is because most of the times the payments/interest required for the banks is cheaper.

Having liabilities can increase the company profits and doesn’t allow the owners lose stock of their ownership of the company. We will discuss the ownership part in the equity section.

Point of Discussion(1): What do you find better having a business with more debt or equity weightage?

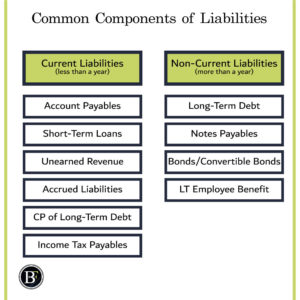

Current Liabilities

It is what the company owes for up to one year. This category is usually important to support the efficiency of the operations because buying on credit allow to extend the products and services provided with least extra money.

Investors may look at the current liabilities and compare it with the current assets. This type of analysis will allow understanding the efficiency of the company operations. Do they manage their short-term sources and uses properly? Are they maximizing the time they have cash with least amount of interest paid?

Account Payable

Is the amount to be paid for products bought on credit within one year period.

For example, if a company sells physical products buying their supply on cash may make them end up in stock in the shop without cash at bank to pay salaries.

Short-Term Loans

These are the types of loans that are taken in short-term less than one-year period. Usually they backup the company’s urgent needs and charge higher interest rates.

For example, a company can utilize an overdraft facility which allows it to access its bank account money beyond its zero limit.

Unearned Revenue

it is when a profit is earned, but the product/service is still required to be delivered.

For example, if a store sold a gift card to a customer. The customer paid in advance, so they have earned the money but they did not give away a product yet.

Accrued Liabilities

It is a when a company received a product or service but still have not paid yet.

For example, let us say a shop owner had an urgent incident where the door lock requires fixing. He called a service company to fix it. After doing that the employee told him I will send you an invoice pay me later and left. From the moment the employee left until he actually sends him an invoice this realised service will remain in accrued expenses.

Another way to remember it that it is like the account payable line, the difference is that they did not receive an invoice for it yet.

Current Portion of Long-Term Debt

It is the amount that have been moved from the long-term debt because it should be paid within a year.

For example, if a company has a property loan for 30 years and part of this amount is the principal payments which are required to be paid this year. That amount will be categorised in the current portion of long-term debt.

Income Taxes Payable

It is the tax required to be paid to the government within one-year.

It depends on the jurisdiction rules but the tax is generally required to be paid as percentage of the company profit. This line items shows the amount that still have not been paid for this period.

Non-current Liabilities

Non-current liabilities are the amounts the company owes for longer than one year.

This category usually presents the loans that have been taken to support the company’s long-term initiatives. Whether it is for buying a new property or building a new manufacturing facility.

Long-Term Debt

It refers to any amount the company owes for more than a year. For example, it could be a property lease agreement payment.

Notes Payable

A note payable is an obligation to pay for products bought on credit for more than one year. It is similar to account payable just with a duration of more than one year.

Bonds

A bond is a loan commitment the company issues for the buyers with a certain target payment/interest structure.

For example, unlike an ordinary loan a company may issue bonds with terms that indicate that they will pay at an end date which includes the full amount and interest. Bonds can also have terms like a typical loan it just depends on how it is structured.

Convertible Bonds

Another notable information about bonds is the convertible bonds. It allows the creditor the right to convert their bonds into stock ownership of the company.

Long-Term Employee Benefit

It refers to the amount that is going to be paid for employees in the long-term that are related to a benefit they received.

Companies tend to offer their employee certain benefits given some conditions. For example, it could be a lifetime health insurance if anything bad happened to the employee.

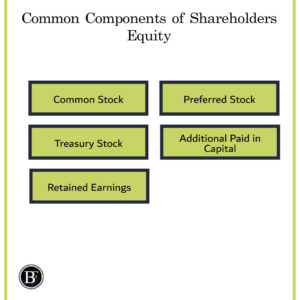

Shareholders Equity

It shows how much the company owners contributed and how much it accumulated in profits.

The term shareholders equity is usually used in corporations balance sheets. The equivalent to small businesses is the owner’s equity.

Investors usually check this section to analyse the capital structure of the company which is identifying how much percentage is ownership (capital) and how much percentage is liabilities (debt).

It also presents the book value which is basically the price of the company if it was purchased based on its value in the balance sheet.

Common Stock

it is the number of shares the owners have. Common stockholders are usually the ones who have the right to take corporate decisions for the company.

Given their high authority they are also last to be paid which is after the creditors and the preferred stockholders.

Preferred stock

It is the number of stocks the preferred stockholders have. These holders are given a preferential treatment by receiving distributions before common stockholders.

But they do have less authority in taking decisions and also receive less of the excess earnings the company would make.

Treasury stock

Corporations have an authorized limit number of common and preferred shares to issue. Treasury is the line items that have the remaining stored or bought back shares which are held by the company.

For example, a company have three equally shared owners (33% ownership each). If the company bought one owner out with its own cash the ownership will be a 50% for the remaining two. That is called share buybacks which will cost the company money, increase value of shares for owners and increase number of treasury stocks available.

On the other hand, the company can issue shares that they were authorised. Which then affect the ownership negatively by adding a new owner. But the positive side they will receive cash for the issuance.

Additional paid in capital

This concept is related to the treasury stock, it represents the additional amount the investor pays over the original price (refers to as par value) of the stock.

Retained Earnings

It will record the accumulated profit of the company less the distributions and share buy backs to investors.

This item mainly change from the income statement results and it can also give a rough idea on how much this company grew its earning over time since its inception.

Final Thoughts

There are many ways to analyse the balance sheet and many valuations techniques. There is still much more depth in the topic. I am interested to know how would you analyse the balance sheet?

If you enjoy the post please let me know if you want me to further discuss each balance sheet line item, analysis, and valuation. here is a link I find interesting from Investopedia if you are looking for numerical aspect of it.

Disclaimer: Above links below are affiliate links and at no additional cost to you, I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful, not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.

Related Posts: