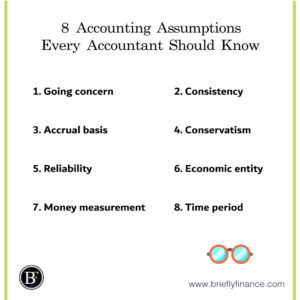

When it comes to preparing a financial report for any organisation or firm, there are some theoretical assumptions that all accountants must follow.

Accounting assumptions are very important for laying the foundation of consistency so that they can be used for assessing the reliability of the financial documents of a business firm while ensuring that the financial health is described therein.

8 Accounting Assumptions That Help in Business

Attribution: The icons has been designed using resources from Flaticon.com

-

Going concern

With this assumption, accountants assume that a business should ensure that it will continue functioning in the future. They assume that the firm won’t go towards bankruptcy and are continuously working towards their objectives and obligations with efficiency.

It reflects that a business entity has the intention to keep on continuing the business operations in the coming years. This, in turn, manifests that the concerned business has no objective of discontinuing or liquidating the business.

-

Consistency

Consistency assumption describes that businesses maintain the same accounting procedure for all the accounting periods and on all practices. But it allows an exception in the cases where opting for some other method would be more efficient and relevant.

When accounting consistency is maintained, it ensures the easy comparison of accounting records over differing periods of accounting. When this assumption isn’t true, the financial statements that are received over different periods of time will not be comparable.

-

Accrual basis

This assumption states that it is important to consider that any revenue of the business transactions is realised at the time when a legal right for receiving it has arisen. Accrual basis is a more logical and practical approach for the determination of profit with cash as the basis of accounting. But it’s worth noting that it exposes a firm to the risk of understanding any income before it is actually received. This implies that an accrual basis runs the risk of overstating any divisible profit.

As a result, for example, when dividend decisions are taken on the basis of unrealised profit, it can pave the way for capital erosion. This is the reason why the accounting standards assumption demands that a business should not recognise any amount unless that the actual realisation amount has been ascertained.

Transactions are recorded with the accrual base of accounting, where the revenue and expense recognition before receiving. And this concept is used for stating the revenue for business transactions has to be considered realised whenever the legal right of receiving it arises.

-

Conservatism

Expenses and revenues must be recognised only when they are earned, but often it so happens that the realisation is biased towards recognition of earlier expenses. When there is any fault with this assumption, a business firm may end up issuing an excessively optimistic financial report.

Again, following with the accrual basis assumption, conservative assumption is ideal and businesses should not unrealistically exaggerate their figures even when they are optimistic.

-

Reliability

The reliability assumption states that transactions that can only be proved should be recorded in accounting records. This implies that all businesses should be able to give proof of all transactions through receipts, statements including both billing and bank. There should be some kind of objective evidence of all business transactions recorded before the firm records them in the accounting records. It is often referred to as an objective assumption.

-

Economic entity

With this assumption, it is assumed that the accounting record of the business, as well as personal accounting of the owner, shall have to be kept distinctly separate. It is against business ethics to mix up the business transactions with the personal transactions of the business owner. This problem is specifically problematic for small and medium-scale businesses.

-

Money measurement

This concept states that all transactions that are meant for recording should be properly recorded and manifested in monetary terms. This assumption termed as money measurement boosts the understanding of the financial condition of the concerned business firm.

-

Time period

Every financial report prepared by a business must cover a consistent period of time. This assumption implies that the methods and practices of accounting used by a business firm must be maintained as well as reported for a specified period of time. These periods must be consistent for each financial year that the business remains in operation.

These time periods may range from monthly to quarterly to annually while maintaining consistency so that records can be compared over previously decided time periods.

Final Thoughts

The accounting assumptions provide the basis of diverse policies and principles related to accounting and put a stop to the non-comparing of various financial statements.

As a result, the accounting assumptions enhance the reliability of all transactions by providing various standards that can become comparable over all the periods of time presented in the report.

Thus, it can be said that the primary objective of accounting standards lies in harmonising various types of accounting policies, which, in turn, help in drafting the final financial reports.

Related Posts:

- 3 Types of Financial Statements Explained

- 5 Key Limitations of the Balance Sheet

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.