The components of income statements line items makes analysing business performance more organised.

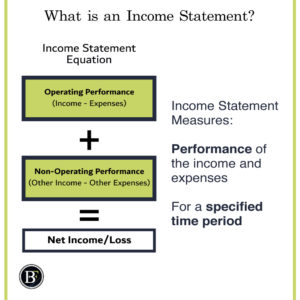

The income statement measures the business performance of its income and expense for a specific time period.

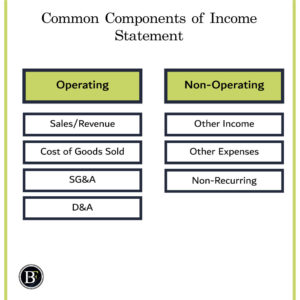

Generally, the income statement is separated into two parts which are operating, and non-operating related. We will discuss the common line items under each of these sections.

You may not find the word “operating” and “non-operating” in an income statement explicitly all the time.But it is good practice to think about it that way.

Because then when analysing the components of income statements you will recognise the performance of the business whether its operations profitability is direct or not direct.

Performance from Operations Section

The operating section will include the income the business make minus its expenses.

Income

Under income you will see the how much the business recognised in revenue, and how much they paid for the goods they sold.

-

Revenue/Sales

The revenue shows the amount the business did/expected to receive over the accounting period.

For example, let us say a car showroom sold a car for a customer on credit. When it is time for the income statement reporting the showroom will show revenue of selling the car as a full amount even though the actual cash received is less.

You may ask “why are they not recording the cash only?”. The answer is because income statement is a measurement of performance and doesn’t show the actual transactions. It is useful for business performance comparisons whether it is by seeing a business historical performance or by comparing two different businesses.

There are many types of revenues like sale of goods, fees of service, subscription, and interest received. If you are interested in reading more about it here is a link to corporate finance institute website.

-

Cost of Goods Sold (COGS)

Cost of goods sold comes under the income section. It is directly related to the manufacturing or service of the product.

For example, it includes the material that is used for manufacturing a certain product

-

Gross Profit (Revenue – Cost of Goods Sold)

It is the profit a business makes after deducting the direct cost of sales. The benefit of having this line item is because it is a good measure for investors to know, how profitable is the product by itself.

It is a good way to compare the product profitability excluding the additional costs. A common ratio used for comparison is the profit margin (Gross Profit / Revenues).

For example, if a restaurant makes a profit margin of 50% it means they still have space to reduce their prices if they want and it is showing that it is profitable. If they make 10% this mean that its tight specially there will be other indirect costs associated.

Expenses

Under the expense section you will see the other costs that the business operations incur.

-

Selling, General and Administrative Expenses (SG&A)

SG&A are the costs that support the operations but they are not directly related to the cost of the business product is selling directly. For example they would be, office rent, office supplies, staff sales commissions.

You may see different income statement layout that doesn’t use SG&A but actually separate each sub-line item by itself which dependant on how the business is approaching it.

-

Depreciation Expense

Depreciation is the amount decrease in the value of the long term assets the business own. These assets are not consumables but they should be losing value over time. They are also referred to as non-current assets.

For example, did you notice some people say “as soon as you buy a new car, once it leaves the showroom it will go down in value.” That decrease is depreciation. It also does happen on yearly basis instead of making it happen one time when the asset breaks.

Again businesses tend to spread the changes in amounts over a specific reporting period to make it a comparable statement.

-

Amortisation Expense

Amortisation is similar to depreciation, the only difference that it is a record of the amount decrease in value of intangible assets.

Intangible assets do have value but can’t be actually seen. For example they could be, patents, and trademarks.

-

Operating Profit (Income from Operations – Expense from operations)

This line item will represent the profit the business is making from its operations purely. It can also refer to the term earning before interest and tax (EBIT).

Performance from Non-Operations Section

This section will have the transactions that are not directly related to the business operations. It shows the income or loss from other sources and which are not recurring.

-

Other Income

Other income would include any gain the business make from non-operation related activity. Let us say for example, selling old office desks. This transaction will be one time only.

-

Special Items/non-recurring transactions

These refer to the income/expenses that are unlikely to happen again and are unique.

For example, let us say a large corporation has multiple businesses and they decide to sell out one of their businesses it will be recorded as income from discontinued operations.

-

Interest Expense

Interest expense is the amount the business should pay for the bank as interest for that reporting period.

-

Other Expenses

Are any other expense that are not directly related to the business operations like taxes, insurance and repairs.

-

Net Income

After counting all the above elements we reach to the final line the net income.

Final Thought on the Components of Income Statements

There are more items we did not discuss, but what i wish you get out of reading about the components of income statements is that income statements measures the business performance whether it is operating or non-operating for a specific period of time.

Related Posts:

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.