As long as there are running businesses, there will always be growing demand for professionals who can prepare and analyse financial information. As a matter of fact, according to US BLS, the projected percentage growth in employment of auditors and accountants from 2019 to 2029 is 4%, which is a stable growth rate.

Accounting main objectives are to identify, record, report and plan the outcome of financial transactions of the business.

In summary, accounting systems enables companies to constantly provide accurate financial data.

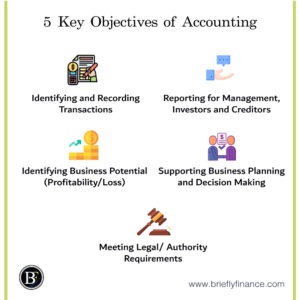

5 Key Objectives of Accounting

Accounting features a number of objectives that can be determined by the type of business and industry it operating in. Let us discuss key of these objectives.

Attribution: The icons has been designed using resources from Flaticon.com

-

Identifying and Recording Transactions

The basis of accounting is to systematically maintain a comprehensive and accurate archived record of business transactions. For instance, accounting systems data can be used as a resource whenever required.

Keeping records is the first step for preparing a report which assists in making informed decisions. In my opinion, financial reporting is crucial to achieving majority of accounting objectives. But reporting can’t be done without identifying and recording the transaction in the first place.

-

Reporting for Management, Investors and Creditors

There are a number of key stakeholders including the management, investors, creditors and the public who want to access the financial reports of an organisation. Financial reports are important and should be available to these parties that allows them to make solid and viable decisions. These Financials are usually published on an annual semi-annual and quarterly basis.

Financial statements also serve the purpose of showing how risky a business is as well as its level of stability. This information is useful for projecting whether or not the company is going to succeed on the long-term.

Investors and creditors analyse financial information to determine if the business is worthwhile the investment.

-

Identifying Business Potential (Profitability/Loss)

Accounting reports provides a summary of quantified financial data including line items like profits and expenses. This data is valuable is for figuring out how well a business performs

Accounting provide companies with a dependable method to review their performance indicators. It helps them to be able to assess how they performed historically and in comparison to their competitors in the industry.

Financial reports are prepared with the completion of the accounting cycle. These reports serve as a reflection of the business financial position/performance for a specified period. Some of the business transactions are profitable and others are losses. The impact of every transaction is aggregated periodically. These reports gives insight on business potential to be profitable or not.

-

Supporting Business Planning and Decision Making

Running a business involves planning how to distribute your resources, which include cash, equipment, machinery and human resources to accomplish the goals of the organisation. One of the essential aspects of managing a business effectively is to budget and prepare in advance with the resources you need to move forward. Thus, having a prepared reports makes communicating with other departments easier.

When it comes to the needs of the departments, management requires trackable financials that assist in strategic business decisions. Managers are responsible for distributing the resources that are used to fulfil the needs of the organisations.

In general, accounting helps managers and investors look forward. The revenues and costs can be anticipated after a substantial amount of information has been compiled. Based on the organisation spending in the past, analysts are in a better position to project the prospects of the future.

-

Meeting Legal/ Authority Requirements

Accounting is regulated by a number of legal, accounting and taxation requirements that are commonly referred to as financial reporting standards that are adhered to globally, for example it includes, the Generally Accepted Accounting Principles (GAAP) in the US, and the IFRS internationally.

Having a unified reporting is necessary for understanding the financial concepts of business globally. The need for a standardised approach to financial reporting has been attributed to the prevalence of companies and shareholders operating on an international scale.

Businesses are legally required to maintain accurate financial records pertaining to their transactions and ensure that regulators, tax authorities and shareholders have access to these reports. Financial data and statements are a necessity for tax filing reasons. All types of businesses are expected to adhere to some legal regulations and restrictions, which include how they should maintain their accounts.

Based on Capital Counsellor, it is estimated that there are over one million employees who work in auditing, accounting, bookkeeping and tax preparation with a steady employment growth rate at 3.46% between 2017 and 2018. These occupations have been diverse and all serve different business and legal requirements.

Final Thoughts

Accounting consists of gathering, measuring, recording and reporting an organisation’s financial information and reporting it through a financial statement.

The main objective is to record the transactions, give an accurate reflection of how a business performs, fulfil financial and legal requirements, and provide stakeholders with financial relevant financial reports.

Related Posts:

- 6 Reasons Why Accounting is the Language of Business

- Is Accounting Hard? 6 Myths and their Realities

- Is Accounting a Good Career | Everything you Need to Know

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.