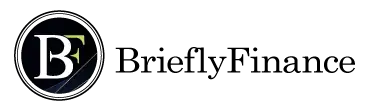

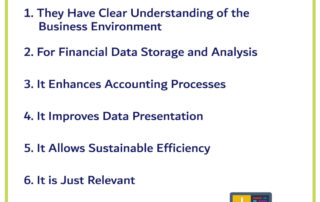

8 Reasons why do you need Accounting Standards

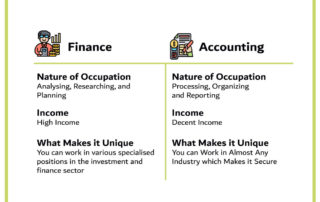

With the financial industry becoming highly internationalised and sophisticated, investments across countries are becoming highly prevalent. To keep up the coherence of the industry, it has become an absolute necessity for the financial reports to be impeccably consistent and compliant with the accounting standards so that investors and analysts can depend on them. The primary advantage of accounting standards is providing precise information through different financial statements in such a way so that it remains comprehensive for all the stakeholders across the industry. Attribution: The icons has been designed using resources from Flaticon.com ...Read More