If your career interest lies in dealing with numbers, you’re probably on the lookout for a degree in a relevant field. While some guides may recommend you take up finances, others may suggest an accounting course. So, which one is best for you?

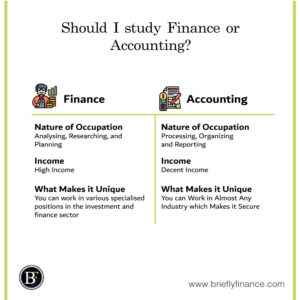

Accounting, in an organisation, deals with the information behind financial transactions. Finance, on the other head, is the management of these transactions. While accounting majorly involves record-keeping, finance is about planning.

Attribution: The icons has been designed using resources from Flaticon.com

Major Differences Between Accounting and Finance Careers

Now that you know the key difference between the two fields, you must be wondering, “How do I choose if my interests overlap?”. To ensure you make the right career choice, I’m going to discuss the contrasting characteristics of these two career paths in a little bit more detail.

Career Choices

Finance is a fairly broad term and encompasses a multitude of career options. If you choose to study finance, you’re likely to end up with a degree that gets you hired as anything from a financial planner to an investment banker.

No matter what your job profile is, you are the one in your company who would be managing the transactions one way or another, steering your organisation towards growing profit margins.

Here are some of the most designations you could work on if you choose to get a degree in finance.

Investment Banker – Typically employed by large, multinational financial houses, an investment banker helps organisations to raise capital. They also play a key role in acquisitions, mergers, and sales.

Financial Broker – A broker is essentially the link between the buyer and a seller. This is true of any field, including finances. As a financial broker, you could be the facilitator of stock trading, wealth management, investment advisor, and so on.

Financial Planner – If you have a knack for understanding investment requirements, this may be the career for you. You can work with individuals or companies to chalk out their financial goals and recommend the most suitable investment options.

Financial Advisor – It is a broader role that encompasses the job descriptions of a financial planner and a broker. An advisor also handles non-investment activities such as savings, taxes, and budgets.

Financial Analyst – The job of an analyst is to study the existing market and predict the trends over a course of time. Analysts require keen brains and an in-depth understanding of the market that they are dealing with so that clients can invest wisely.

Fund Manager – Typically employed by mutual fund organisations, a fund manager is responsible for everything related to a particular mutual fund scheme.

Risk Analyst – Much like financial analysts, risk analysts also study the current state of the market and assess the risks involved from a company’s perspective, taking into consideration the company’s financial status and goals.

Portfolio Manager – A portfolio manager makes investment decisions for a client, and is the person who has the final say in the purchase of securities, funds, and the different aspects of trading.

As you can see, a lot of the above career paths are intertwined, and some of them are also the stepping stones to get to the next level.

Now, let’s look at some of the popular career options for accounting degree holders.

Financial Accounting – This is the most common career option for accounting and is probably where you’d start. It involves preparing the financial documents of a company, including the balance sheet, the income statement, and the cash flow statement.

Managerial Accounting – In addition to creating the basic financial documents, managerial accountants also work on budget and forecasting along with financial analysts.

Cost Accounting – If a company plans to launch a new product or service, they are likely to hire a cost accountant. It is the cost accountant’s job to analyse the costs involved to create and launch the respective product or service.

Certified Public Accounting – A certified public accountant (CPA) is a licensed individual who prepares a company’s financial documents that are to be made publicly available. These are people who create statements of income for listed companies.

Forensic Accounting – Typically employed by law enforcement establishments, the job of a forensic accountant is to identify financial frauds, embezzlements, and other illegal activities dealing with an organisation’s financial data.

Salaries

Let’s talk money! Well, we were talking about money when we started outlining the differences between a career in finance and one in accounting. But now is the time to discuss your money.

How much do these careers pay? Will one type of career make you wealthier than another? Here are some points to consider.

In both finance and accounting, salaries can vary depending on your job profile. And as with any career path, the higher you go up the ladder, the more you earn.

Having said that, here are some key figures from the U.S. Bureau of Labor Statistics (BLS) to give you a clearer picture of how much you can earn in these fields. These were all median pay for the year 2020.

Financial Managers: $134,180 per year or $64.51 per hour.

Financial Analysts: $83,660 per year or $40.22 per hour.

Financial Advisors: $89,330 per year or $42.95 per hour.

Accountants and auditors: $73,560 per year or $35.37 per hour.

Budget Analysts: $78,970 per year or $37.97 per hour.

I think it’s safe to conclude that in general, a degree in finance can attract higher salaries than a degree in accounting. However, do keep in mind that some of the highest paying finance jobs, such as investment banking, also involve long and grueling working hours.

Job Security

While salary is one of the first things to look for in a career option, a long-term approach would be to evaluate the job security of the particular domain. Some jobs pay you more but involve way too much risk. You’re always on your toes as you never who is the next person to get fired.

If working for a company for a year or less is your aim, this aspect may not matter much. But if you’re in this domain for a greater part of your working life, you must look for relatively low-risk jobs.

So, is it a finance career that provides better job security, or are the offerings better with accounting jobs? Let’s have a look.

For the most part, both finance and accounting career paths offer similar job security. According to BLS, between 2019 and 2029, financial analyst jobs are expected to grow at a rate of 5%, while the growth rate for accounting jobs is forecasted to be 4%.

So, in the current scenario, you’re likely to find and stick to a finance job as well as an accounting job. However, finance is a specialised field and includes different kinds of career paths as we’ve seen earlier.

Some career paths, such as investment banking, financial brokerage, and others that deal with trading are dependent on the volatility of the market. And hence, these are the jobs that don’t provide comfortable job security as compared to other low-risk paths such as those of financial advisors, planners, and analysts.

On the other hand, accounting career paths are diverse across almost every industry and not restricted to financial sector only. After all every business needs accounting sooner or later.

Pre-Requisites

Regardless of whether you choose a career in finance or accounting, a bachelor’s degree is the minimum requirement for you to land a job in any organisation. Once you’re in the accounting field, if you would like to opt for career growth as a CPA, you’d have to take up an additional 150 credits.

For finance jobs, although a bachelor’s degree would get you entry-level positions, you could be stuck there if you don’t have an advanced degree. A master’s degree in finance can aid in climbing up the corporate ladder and get you jobs that report directly to a company’s chief financial officer (CFO).

Some basic skills that are a common requirement for both accounting and finance jobs include excellent verbal and written communication, the ability to crunch numbers efficiently, and possessing an eye for detail.

Coursework

Even if one of the two career paths sounds more attractive to you, you should first carefully evaluate the coursework before enrolling in a degree program. When you look at the study materials, you may see some significant overlap in the coursework of the two degrees. However, there are differences in the overall approach.

While finance courses tend to be more analytical, accounting courses delve more into processes. You’ll learn more about mathematical modelling, market evaluation, risk analysis, and financial management theory in a finance degree.

Contrarily, the coursework for an accounting degree would have you study more of accounting and auditing practices, along with taxation, and some bit of quantitative analysis. Also, most of the accounting courses are mandatory courses while a finance degree offers a larger number of electives.

Final Thoughts

Whether you pick a career in accounting or finance, your contribution is likely to enhance your client’s or organisation’s overall financial capabilities. Both careers have the potential to add a lot of value to the economy and also to your professional growth.

While at the onset these two career paths may look similar, there are some clear-cut distinctions. Working in the finance domain is more to do with managing the money, while accountants and auditors have records to keep.

The finance domain offers a more lucrative salary and a wider range of career options, but accounting jobs are not too far behind. Both careers can be satisfying and provide enough job security depending on the job profile.

Choose your career as per your liking for not just the job description but also the coursework that you’ll have to attend in college. Ultimately, both careers can be sufficiently challenging and rewarding at the same time for those who are willing to learn.

Related Posts:

- 6 Reasons Why Accounting is the Language of Business

- Is Accounting Hard? 6 Myths and their Realities

- Is Accounting a Good Career | Everything you Need to Know

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.