With the financial industry becoming highly internationalised and sophisticated, investments across countries are becoming highly prevalent. To keep up the coherence of the industry, it has become an absolute necessity for the financial reports to be impeccably consistent and compliant with the accounting standards so that investors and analysts can depend on them.

The primary advantage of accounting standards is providing precise information through different financial statements in such a way so that it remains comprehensive for all the stakeholders across the industry.

Attribution: The icons has been designed using resources from Flaticon.com

The Purpose of Accounting Standards

The accounting standards are required for the financial statements to be presented in such a way so that comparing statements with other financial reports becomes easy.

If all the business firms were allowed to report the financial outcomes in any manner without having a standardization, then the data would have been useless for the shareholders and the investors when doing comparisons.

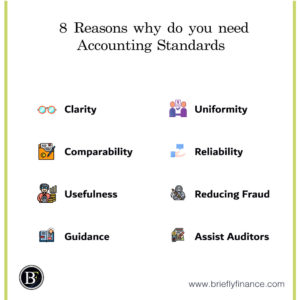

8 Reasons why you need Accounting Standard

1. Clarity: First of all, it can easily rule out ambiguity. When an accountant is working for any company, there will be multiple times where they have to encounter confusion and variations regarding the kind of accounting treatment to be deployed for a specific transaction. Accounting standards play a considerable role in such situations.

2. Comparability: Any investor would essentially want the financial statements to be comparable others. Without any standardised regulation, this comparison would become next to impossible since there will be varying accounting treatments.

3. Usefulness: Besides facilitating comparison, a company also has disclosure requirements where they have to present the details to the stakeholders for easing the comprehension of financial statements. Moreover, accounting standards aids in disseminating useful financial data to the users as well as stakeholders.

4. Guidance: Standardisation of accounting is very helpful in providing daily guidance to accountants for making sure the steady operation of the company. It is the sole responsibility of an accountant for providing financial information which is reliable, relevant, neutral, and comparable- basically, all the components achieved by sticking to the account standards.

5. Uniformity: As it is already mentioned accounting standards can help a business achieve the right accounting treatment while recording the various events and transactions. It also has a set format for financial statements which helps a business concern in attaining uniformity in the modes of accounting.

6. Reliability: Any business concern has tons of stakeholders and they also rely on the information for making an informed decision of the company. Many stakeholders determine their next course of action on the information provided by these financial statements. Moreover, a business needs to keep in mind the requirements of potential investors who decide whether or not they want to do business with the company based on the financial reports. Thus, it’s very important that the financial statements present a true picture of the financial condition of the firm. And to make this possible, the role of accounting standards can never be denied.

7. Reducing Fraud: Accounting standards also lays down the accounting principles, procedures, and methods that every entity must abide by. One of the major outcomes of this is the business management being checked from manipulating financial data by any chance. It makes it difficult for committing any manipulations.

8. Assist Auditors: The accounting standards facilitate laying down all the necessary policies, regulations, and guidelines pertaining to transactions in an approved written format. And all companies have to follow it. So when the time comes to get things audited by the auditors, they can check that everything has been rightly followed and all the financial statements thus presented are true and justified.

Final Thoughts

To sum up, the benefits of financial standards lie in boosting the international comparability of the financial data so that the prospective investors and other participants of the market can take the right steps for revenue generation. It also improves accountability by lowering the data gap between the capital suppliers and the people entrusted with that money.

It is almost impossible to run a business without encountering the accounting standards. They are the tested and proven means of ensuring that the data thus accumulated about the various affairs of the company caters to the needs and consistency of the business.

Related Posts:

- 6 Financial Advice I Would Give My Younger Self

- 3 Practical Investing Books You Should Read

- 3 Must Have Value Investing Books for Beginners

Disclaimer: Above links includes affiliate links and at no additional cost to you, I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful, not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.