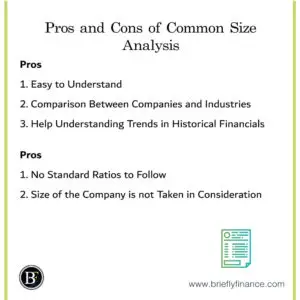

One of the techniques in overall financial statement analysis is preparing a common size analysis of a business where you can compare its financial position and performance year by year (time-series) or through comparing it with other companies (cross-sectional). But the question is, how actually good is common size analysis and what are its limitations?

The key benefit of common size analysis is it is easy to understand providing initial perception about the financials. While the main limitation is that there is no standard ratios to follow and the company size is not considered in the analysis.

Before jumping to the pros and cons of common size analysis, let us have a quick recap on the concept.

What is Common Size Analysis

Common size analysis evaluates the business performance by presenting the percentage of the line item (for example cost of goods sold) as a percentage of a base amount line item (for example total sale). That metric is an indicator of how the business is positioned (in terms of percentage).

For instance, a common size analysis for an income statement with an increasing ratio of expenses to sales year over year means that there is possibly an issue in either lower sales or increasing the costs.

As an analyst you may want to take it to the next step and think “is this percentage similar to other companies?”. The good thing about this analysis that it gives you the percentages which allows you to compare between companies and industries.

Attribution: The icons has been designed using resources from Flaticon.com

Pros of Common Size Analysis

-

Easy to understand

The common size analysis helps you easily be able to know what portion of the line items are percentage of their base item. For example percentage of cost of goods sold out of the total sales in an income statement can give you idea how much the portion of the production related to the sale cost.

-

Comparison Between Companies and Industries

It helps in the comparison process between companies and industry as a whole. Sometimes you may want to compare these percentages to know how a competitor is managing their financials. Or you want to look at the industry median that allow you see in general how the whole industry managing their financials.

-

Help Understand Trends in Historical Financials

The common size statement analysis also helps knowing how the company is developing over the years, for example, seeing if they are saving money or are they spending much.

These significant changes can be valuable indicators for the analyst to know whether this business is consistent or not.

Cons of Common Size Analysis

-

No Standard Ratios to Follow

Knowing the common size analysis percentages may not assist in taking informed decisions. It does not present the full picture.

For example, high debt to financing ratio is clear indictor that can help analysing taking decision about the business financial stability which can’t be clearly assessed with the common size analysis statements.

-

Size of the Company is not taken in consideration

Because this statement only shows percentages without the actual figures, company size is not taken in consideration which makes it hard for the analyst to know whether the business is growing or not and there are no strong basis when comparing it with other companies.

Final Thoughts

If you are into investing or just into business in general, I think you will like to have the common size analysis part of your analysis as it will give you a first impression in a glance of the company you are researching.

I believe that this analysis is useful but it has to be used along other type of techniques like ratio analysis and fundamental research on the company to properly take decisions.

Related Posts:

- 3 Types of Financial Statements Explained

- 5 Key Limitations of the Balance Sheet

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.