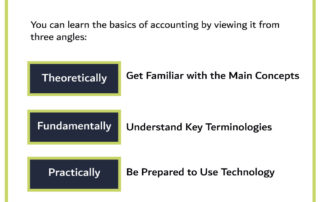

How to Learn Basics of Accounting – Getting Started Guide

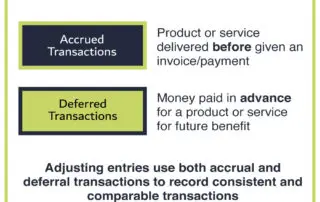

Accounting is a skill every individual should be aware of, no matter what the profession. You do not have to know everything. However, understanding the basic concepts, and terminologies of accounting will prepare you to understand how business financials work. For example, let us say a small business owner had to review an income statement prepared by his accountant. The business owner may end up wondering how come the sales are higher than the actual cash he received? understanding the accrual concept can make significant difference in improving your ability to learn accounting. My aim ...Read More