Investing has been very common nowadays; the ease of access through the online trading and brokerage tools influenced how much we invest. Now more than ever, it became important to understand the ways of recording investment transactions for businesses and investors.

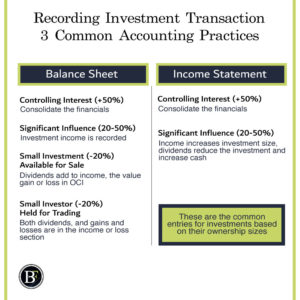

To record your investment transactions, you use the equity method, available for sale, held for trading, and fair value through profit and loss. Each method will depend on the size of the investment you made.

Why are there Many Methods?

The reason is because each business has different goal when holding their investments. Some prefer to keep it for the long-term, while others want to sell it when an opportunity arise.

It is also different recording practice based on the ownership percentage of the investment. For example, If a business own few shares of Apple they will not have access to all the financials before the statements reporting take place. But they can still use the share price.

But if a business own 80% of an investment they can demand access to see all the related financial statements making it relevant for them to share a combined financial statement on their report.

Let us see the different scenarios and the common practice in recording investment transactions.

-

Controlling Interest (+50% Ownership)

If a business owns more than 50%, then ideally, they should have full access and will prepare a consolidated financial statements.

The consolidated financial statement will consolidate/combine the records of the owner/parent company and the investment/subsidiary that they own which in this case more than 50%.

You may wonder, if the parent company consolidated other statements it will exaggerate what it owns in reality! That is true, this is why consolidated statements include a line called minority interest in balance sheet and income statement to remove the figures that the parent company do not own.

Basically, because they own more than 50% they can just combine both businesses performance and then remove out the other minority shareholders.

-

Significant Influence (20-50% Ownership)

The second scenario is when a business has significant influence by owning 20-50% of an investment.

They can record that investment by using the equity method. In equity method the investing company records the investment initially at cost which is often called investment in associates in the balance sheet.

After the purchase of the investment, over the years the profit or loss the investment generated is accumulated on the initial cost. Also any dividends received from the investment is subtracted from the cost of investment.

After recording the investment associates figure initially at cost, it changes based on profits/loss of the investment and also decrease based on dividends distribution that is the equity method.

-

Small Investment (-20% Ownership)

Finally, for ownership of 20% or less. The business have two different situations where it either keep the investment available for sale or holds it for trading.

In other words, imagine that a business invested and have a choice based on its strategy. Either to act as an active investor and hold the investment for trading or a passive investor and make it available for sale.

Available for sale

The available for sale would represent investment that a company has bought and is expecting to sell but not in the short run. For example, a company can record a property they listed for sale as available for sale.

It records the unrealised gains (gain in asset value) in other comprehensive income section of the income statement while the realised gains and losses (actual profit) or dividends are in profit or loss section of the income statement.

Available for sale investments dividends received increase the profit. While the investment value gained/loss influence the other comprehensive income.

Held for trading

Companies that intends to trade their investment frequently use held for trading investment category. Let say they are stocks that the company day trade with.

Held for trading investment method records the current price of the investment as a fair value on each reporting period. Whenever there is an increase or decrease between reporting periods they record it as profit/loss. They also record both the dividends as part of the profit.

Final thought

The above post had common practices in recording investment transactions. I understand the topic may have a grey area because there are various accounting rules and industry difference around it.

My goal from this post is to make sure to help you understand the topic. I hope you will be able to fully “get it” whenever you plan in getting into more details.

Let me know if you find the information useful. Please do not forget to share with someone you know or may have discussed this topic with before.

Related Posts:

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.