NFTs transactions are recorded in the blockchain network. Any interaction that is recorded will require computational energy thus it comes with costs which is called gas fees.

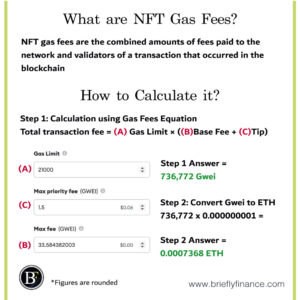

NFT gas fees are the combined amounts of fees paid to the network and validators of a transaction that occurred in the blockchain.

We will further discuss gas fees and how it work with its calculation process. Our focus will be around the Ethereum and little bit of Solana blockchains as they are the two most popular networks for NFTs.

What are gas fees?

Gas

Gas is basically refers to the power required to do a transaction on the blockchain. It is a term to describe the fuel required to generate a transaction in the blockchain.

Gas Fee

Is the amount charged to compensate the miners for using their resources to validate the transactions. It also includes tokens that will be burned in the process.

But what do miners do to validate transactions and make profit?

As a quick recap, a blockchain is basically a peer-to-peer network which means it is a group of computers around the world running to keep record and validate transactions. Each of these computers can be as a miner/validator who ensure that the transaction processed is valid, validate this transaction and gets rewarded.

Here are two examples of how Ethereum and Solana validate the transactions and get compensated with gas fees:

- Ethereum use Proof of Work (PoW) consensus mechanism, where computers consumes energy to solve a mathematical calculations and the first computer who finds the solution gets compensated prior to recording and validating the transaction in the blockchain.

- Solana uses proof of stake (PoS) Consensus mechanism, where energy is minimally consumed by staking (keeping) the tokens as a validators in the network and get randomly compensated based on their time and amount of token staked.

As you will see later Ethereum charge more gas fees because of the PoW consumption of more energy. Anyway, if you want to know more about the protocols check out this link from Coinbase. Let us carry on with gas fees.

Unit of Gas Fees (Ethereum)

Because gas fees are generally low in comparison to the actual token coin, there is a name for the unit of gas fee which is basically a denomination of ETH which is called Gwei.

Basically, 1 ETH = 1 Billion Gwei. inversely a Gwei is equal to 0.000000001 ETH. So it is similar to using different terms for different dollar bills like pennies, quarters and so on.

When do you Pay NFT Gas Fees?

NFT gas fees tend to be paid in different stages of transactions that interacts with NFT marketplace, including account registration, buying and selling and listing items and much more.

Checkout this OpenSea link, if you want to look at the full details on when gas fees are paid for NFTs.

How are NFT Gas Fees Calculated?

Ethereum

OK, now we understood the key concepts, let us go little bit deeper about the calculation of gas fees. The calculation formula is basically:

Total transaction fee = Gas Limit × (Base Fee + Tip)

Gas Limit is basically the maximum amount of gas you like to spend. The standard lowest limit is 21,000 units of Gas for a typical “Eth transfer” transaction.

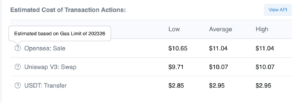

Generally, this amount is determined through an API of what is the limit based on the type of transaction and network congestion. This means it will be auto generated by your wallet when doing a transaction.

As you can see below is example of the estimated least amount of gas units required for OpenSea sale at that given time.

Source: https://etherscan.io/gastracker

Base Fee: Is the amount which is influenced by the demand and supply of the network. This is generated automatically too, but also influenced by how much max fee you are willing to pay as a user. This amount is going to be burned once the transaction takes place.

Tip: is the extra amount assigned by users beyond the basic gas fees which goes as profit for the miner/validator.

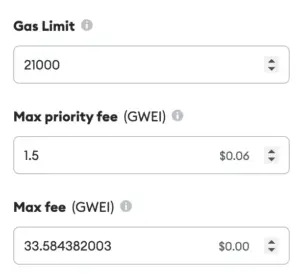

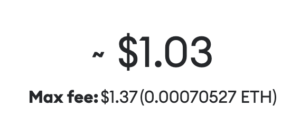

Below is an example of a transfer performed in Metamask:

In Metamask, once you initiate a transaction. If you click on the “Edit” next to the gas fees then click “advanced options” you will notice the table on the top. These are the items we can use for calculating our Gas fees.

Gas limit is 21,000 which is kept as standard “Gas limit”. The max priority fee is the “tip” that goes to the miners, and finally “max fee” is the base fee (which we could get refunded if we pay less when transaction takes place).

Let us calculate:

Step 1: Calculating the total transaction fee in Gwei

Total transaction fee = Gas Limit × (Base Fee + Tip)

= 21,000 x (33.584 + 1.5)

= 21,000 x 35.084

= 736,764 Gwei

Step 2: Gwei to Eth conversion

Once you get the final number in Gwei you just basically multiply it by 0.000000001 to get the Eth value

736,764 x 0.000000001 = ~0.000736764 eth

Congratulations! now you know how to calculate gas fees! Yes there is minor difference between what Metamask generated figure and what we calculated due to figures being rounded.

Solana

Let us look at another blockchain for calculating NFT fees. Solana is a notable one and the second largest after Ethereum despite the big gap of popularity between them.

Given that the network operate with a Proof of Stake protocol which does not require high computation energy and due to the lower demand compared to Ethereum. Solana transaction costs are typically lower with an average of $0.00025 per transaction (May 2022).

The calculation of the fees will just be based on how much demand is there to it.

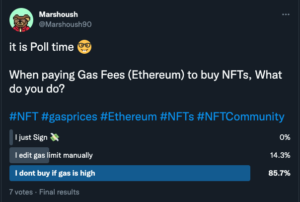

Please follow me @Marshoush90 so we have more votes in the future!

Final Thoughts

The space is getting popular day by day and gas fees sometimes get unreasonably high (higher even than the NFT you want to buy).

Ideally, best way to avoid gas fee is to do your transaction when the Gwei is low. I like to use the Etherscan gas tracker as an indicator of the gas fees. Personally if the average 50 Gwei I go for it and do my transaction.

Related Posts:

- 12 NFT Marketplaces you Should use

- What NFTs Should I buy? a Comprehensive Guide

- Can NFTs be Deleted? What are Burning/Disappearing NFTs?

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.