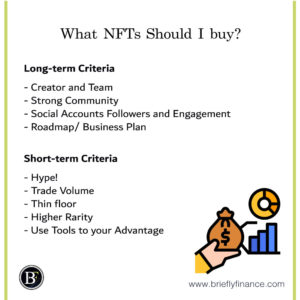

Buying NFTs is one of the riskiest decisions you may take specially if your purposes is investing. When buying one, you will need to know what is your goal, do you want to keep it as a digital art? Invest for long-term returns? Or trade for the short-term?

Investing into NFTs can be categorised into two type of analysis, one is by buying in long-term projects which are known as blue chips, and the other way is by short-term trading NFTs which includes many techniques like buying the hype, snipping, and flip from mint stage.

Attribution: The icons has been designed using resources from Flaticon.com

Disclaimer: Before we start, just know that his is not a financial advice MAKE SURE YOU ONLY Invest with money you are willing to lose.

Long-term Criteria

-

Creator and Team

Review the leadership of the project. Having a consistent leader with an impact whether it is the execution of the roadmap (business plan), or just as being an influencer that can drive the community excitement consistently.

Criteria:

Big Potential: Does the team has a famous artist or a one that has potential to be famous? Does the team have a founder or even an influencer on board that could alone drive the community excitement and demand?

Running Business Skills: Is the team good at running this project? do they have a track record that back it up?

Identifiable Team: Are they identifiable or all anonymous? Some may prefer being anonymous for security reasons which is understood but we have to give credit to a team that put themselves with their reputation on the line.

Source: https://twitter.com/TomBilyeu

Above example of a person who I see as a strong founder. Tom is the creator of the Impact Theory Founders Key. He is also Co-Founder of Impact Theory and Quest Nutrition with a track record of successfully running his current and exited businesses.

-

Strong Community

NFT Communities are possibly one of the strongest type of communities in the 21st century. Think about it, they all own the similar items in a collection and have similar interest and a goal to grow their bond and money together.

Having it as a criteria is very important, at the end of the day as a long-term investor you are indirectly associating yourself with the members of whatever collection you get into.

Criteria:

Mutual Interest between Members: At early stage of any project it is going to be hard to identify the strength of the community because of all the hype. Unfortunately members would hype things up then all of a sudden sell out shortly once the project goes up.

But if you can identify the mutual interests that would create a bond between the community members it will have a much stronger potential to sustain itself over the long-term.

Age of the Project: Most projects start with high engagement at early stage but later after few weeks the members start to either get bored or sell. However, there are some communities that will continue interacting and chatting, the longer the project life since its started and the chatting continue the better it is for you as a buyer.

How welcoming are they: A great community is also a one that is easy for new members to fit in. You may encounter great communities but given they knew each other for a while they would not bother answering new members questions or let them involved which is not a good sign for sustainable project.

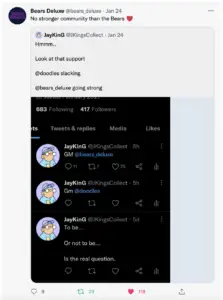

Source: https://twitter.com/bears_deluxe/status/1485392407973744644

Bears Deluxe has been a strong community on to an extent other project members talk about them.

-

Social Accounts Followers and Engagement

A good indicator of a project brand awareness is their social media accounts. Visit their Twitter, Discord and any other network they have linked on their website/NFT collections page.

Criteria:

Just make sure the users are Really Engaged: Instead of just looking at how many retweets been made and likes. Check out what do people say? Are they legit or do you feel that they could be bots.

Only Real Followers Count: The same case applies to followers, if an account has more than 100k followers but the users barely engage make sure they are not just fake accounts.

Too much giveaways is not always good: Be aware from the accounts that do much giveaways and nothing else; cause they will have users that follow them just to win and not necessarily care about the project itself.

The more you browse through different social media accounts the easier it will get to identify their authenticity.

-

Roadmap/ Business Plan

Most NFT projects have a roadmap describing their plans to their holders over a specified time-frame. It is one of the key aspects to look at. It is a presentation of how do the founders think and plan to go with the project.

Criteria:

Is it a Copycat Project: Many projects tend to just be a copy to other successful projects, in terms of the art and even the utility. I do not want to mention name of projects here. But trust me you will realise there is this type of repetition.

Let us make something up. Assume “HappyCows” is a successful project. You will find many variation of new projects with almost exact same art and utility they would be called something like “HappyCows in a bus” or “SadCows”. Most of the time these are just for short-term flippers who get easy hype and dump the project.

Is the Plan Original: You will also recognised repeated pattern with what projects do. Like giveaways, charity, and merchandise. I know many successful projects do that, its just if you see these as a key plan in a proposed strategies I would highly recommend make sure that other criteria is much more convincing to get you in the project.

Find a Disruptive Plan: On the other side, there are certain projects that pop up with unique ideas that drives demand so high and disrupt the market.

Check out below a disruptive project called Book Games by Gary Vaynerchuck who linked NFTs to his best-selling book.

Source: https://veefriends.com/book-games

-

Ratios to Look at

There are few quick tricks you can do to identify how healthy is the NFT collection is. Of course the floor price is a quick indicator of how much people are willing to sell their NFT and if its above the initial mint price (primary market price) then it could be a good indicator. Here are also two other ways.

Criteria:

Items/Owners Ratio: When you divide number of items in a collection to number of the owners you will find out on average how much each owner have in the collection. A high number of 10 or more can be a red flag because there could be someone there that want to sell out and this action will have a bigger impact than if only one person wants to sell. Ideally the figure should be around 3-4 items by owner.

Just keep in mind it also depend on the cycle of the NFT, it will be different if the project is just new and some owners are really excited about it that they aped in. But when it comes to an old project it may have be a negative sign because this mean the project is still not distributed for good number of members to build a reliable community.

Bored Ape Yacht Club an example of a healthy 1-2 items ratio per owner.

Source: https://looksrare.org/collections/0xBC4CA0EdA7647A8aB7C2061c2E118A18a936f13D

Number of Items for Sale to the Total Number of Items: This ratio will allow you to identify how much of the collection is being listed for sale as percentage of total collection. It is a measure to know to what extent the owners are willing to sell.

A normal ratio can be from 10-15% a lower means the owners may not want to sell cause they are very happy or maybe cause the price is still low and they want it to go higher, either ways its good.

Source: https://opensea.io/collection/boredapeyachtclub

-

Also…

Don’t rush

As a long-term buyer, there is no need to jump quickly in a project. Keep in mind there is a common cycle in the NFT space (So far on most projects). A NFT project starts with high demand due to the hype in the mint and first few days then the price gradually falls down. Decline in price could take weeks and maybe months where the traders leave the project and long-term holders join and stay in.

Just keep in mind this is not set in stone. Some projects just goes up and slow down at a high price range. Usually these are the projects sell out in seconds on the minting stage most of the time.

Get what you like

OK Let us just be realistic you may lose all your money in any project no matter how much analysis you do. For me this is the best advice I could tell someone, if you really like the project as a whole just buy it.

One day in the future of NFTs everyone will be in few projects that they like and would not change no matter what the price mark is. If you find a project you think is the one you should go ahead and ape in.

Revisit your Project

As a long-term holder, just keep in mind that the NFT space moves fast. Re-reviewing a collection you purchased every now and then helps a lot. Unlike public stocks where there are official quarterly calls, with NFTs you have to revisit your initial assumptions, ask questions and review discord to make sure everything is still on track.

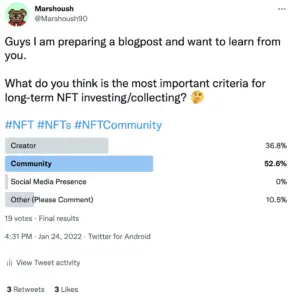

Source: https://twitter.com/Marshoush90/status/1485606161982312449

Note: before going to the next section. I just wanted to let you know.

If you are looking for a secured wallet that adds extra layer of security to your assets in your NFTs/Crypto journey, I would recommend checking out Ledger . Personally, I use Ledger Nano S as it does the job i need and it is affordable.

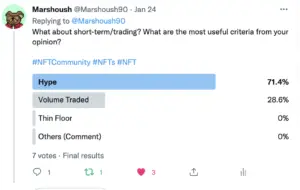

Short-term Criteria

Traders in the NFT space may not look at the fundamentals as they need to be quick when buying and selling. They time their purchase based on the project current stage in the cycle, the tools and tactics they have.

Just keep in mind, for trading (in Ethereum NFTs particularly) the fees can be very high and sometimes more expensive than the NFTs themselves. Whatever decision you take should always keep the fees in mind.

-

Hype!

One of the main drivers for the price increase in any NFT project is the excitement gets around the project. Whether it’s the art like Mekaverse or the creator (whatever Gary Vaynerchuck release).

Criteria:

Make sure to time it right: Most of the short-term profits generated are usually for users who have been whitelisted and were able to mint the project. A hyped project price usually have a spike in the secondary market at its early stage but then slows down.

Source: https://opensea.io/collection/mekaverse

The above Sale and volume activity is related to Mekaverse, a project that was one if not the most hyped project in 2021. The average price of these NFTs reached up to 7 eth after launch. Today it is around 1 eth.

-

Trade Volume

High trade volume is a good indicator that the project is doing well (on its early stages). When you go to the activity tab of a collection if sales were being placed multiple times within short period the one hour range this could mean a good.

A higher volume allows traders to quickly sell what they have and that is an advantage. It will also minimise the risk of losing much money due to the illiquidity risk.

Source: https://opensea.io/collection/azuki

Azuki’s collection above is a good example. This may not be always the case because a well-established bluechip project with loyal community will have a low trade volume but that usually happen after few months from the project launch.

-

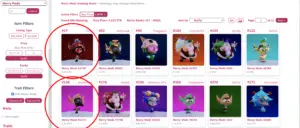

Thin floor

A common quick way to profit is to look at a high volume collection, find the cheapest item and see what is the next item selling for. If there is big difference you can instantly buy the floor and sell at lowest price again making a quick profit.

This usually happen when sellers are in a hurry and want to get their money quick.

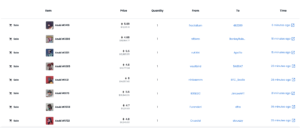

Source: https://looksrare.org/collections/0x4BB33f6E69fd62cf3abbcC6F1F43b94A5D572C2B

Above example is bears deluxe in Looksrare website, if you see the lowest price bear is 1.45eth and the one after it is 1.75eth so there is 0.3eth difference which you can buy the lowest and set the price to 1.75eth.

Note that you need to check other marketplaces (like OpenSea) because the prices there are different too.

-

Higher Rarity

One of the unique aspects of NFTs is how each item in the collection is different most of the time. This introduces the idea “collecting” and rarities in the space.

A top 10 rarest item in a collection could be 20x more expensive than the low rarity score NFT. Some sellers do not pay attention to this element or they are in need of the money quickly and end up listing valuable NFTs at a low price.

A useful tool that can help you with that is Rarity Tool.

For example, below is Merry Modz collection, you can see that I filtered the max price to 1 eth and sorted the collection by rarity. If you notice the 17th most rare is in this list at 0.95 eth and a notable one is the 156th for only 0.36 eth both look decent to buy if you are interested in that project.

Source: https://rarity.tools/merry-modz

-

Use Tools for your Advantage

Just as rarity tool is helpful, there are also many other useful tools. Like Nansen, a tool that alert you if an item been purchased by well-known wealthy collector, or Dune Analytics that provide details on the NFT market overview volume and much more.

NFT tools needs a whole new post which I am planning to develop in the future. But for now, you can look at this article which has decent tools to use.

Source:

https://twitter.com/Marshoush90/status/1485606796576370691

Final Thoughts

This post is not intended to overwhelm you but is prepared to make you a checklist you can follow. Don’t be discouraged because if you felt it is overloaded. The more you research the more knowledge accumulates and it gets fun over time.

The more you learn the easier you will find the good bets.

Related Posts:

- Why are NFTs Expensive? 7 Reasons that Makes NFTs Valuable

- Are NFTs a Pyramid Scheme? 4 Reasons Why it Feels Like it

- Is NFT a Cryptocurrency? NFTs vs. Cryptocurrencies Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.