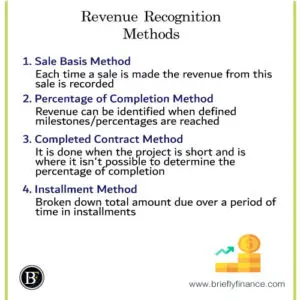

While accounting methods are used for many different entities, they can be complex. It can be hard to know which one is right for you to use in your business. When it comes to revenue recognition methods there are key methods that we will address in this post.

Utilising various revenue recognition method of accounting, you can customise it to fit your needs. A business changes over time, and the method you use needs to continue to be valuable when such changes are implemented. Make sure the system you rely on allows the business to customise billing and pricing. This saves time, increases cash flow, and helps reduce the risk of errors.

Below are some of the concepts to consider. When you evaluate what they offer, you can see how they stack up against your own business needs. It can be useful to make a list of what the system should offer before you get started. Then you can analyse the options and make the best choice! Make sure the one you select will conform to regulations of your jurisdictions for example IFRS or GAAP.

Attribution: The icons has been designed using resources from Flaticon.com

Sales Basis Method

The sales basis method is a popular revenue recognition method of accounting. Each time a sale is made the revenue from it is recorded. This is consistent with all transactions, including those when the payment isn’t made at the same time the sale is completed. Sometimes, customers will pay in advance.

Their goods will be delivered later on, but the money they paid isn’t recorded until the sales transaction takes place. This is considered the point in time when the product is delivered to them. Most small businesses use the sales basis method of accounting.

Advantages

- Easy to use concept

- Accurate cash flow so you can see how much cash is on hand at a given point in time

- Single entry system makes it easy to use without a complex accounting system.

Disadvantages

- The single-entry system increases the risk of errors. A double-entry system offers a check and balance for each entry to be verified.

- It works well for short-term data but makes it harder to see the overall big picture of your business. It doesn’t include income earned but not received. When you have a profitable month did your business increase or did more outstanding invoices get paid in that period?

Percentage of Completion Method

Before you decide to use the percentage of completion method of accounting, you have to make sure you meet the requirements which includes:

- A long-term contract is in place that can be legally enforced. It must be at least 1 year or longer in duration.

- The project percentage of completion can be fairly estimated.

When both of these elements are present the method can be used successfully. There are two different ways it can be implemented. It is important to decide which one to use for your business and then stick with it. You can’t go back and forth with the two methods. All of your accounting needs to follow the same method.

- Option #1 – Revenue can be identified when defined milestones are reached. Those milestones will depend on the parameters of the business you offer. It can be used both for goods and services but needs to be consistent. This is a good idea for larger projects that take plenty of money to complete and/or plenty of time. This allows payment to be made at intervals as the project reaches those set milestones. This can alleviate the risk of cash flow problems if you wait until the end of the project to be paid.

- Option #2 – Revenue can be identified when a percentage of the job is considered to be complete. The parameters need to be set up at the start and the percentages identified. Your business may decide to get paid each time 25% of the project is deemed complete rather than when it is all done.

Be careful with the percentage of completion method. It can be misleading at times with your accounting information. Aligning the completion of work and the expenses for the work can be impossible to do with many of the projects.

Advantages

- Increases cash flow because you have income coming in at intervals for each project.

- Reduces the risk of customers not paying for a project and you incur a huge loss of income because of it.

- Offers a real-time estimation for your business relating to the revenue and cost related to each project.

Disadvantages

- This method can be time-consuming because you have to stay on top of each project. You have to decide if you will continue to move the project forward to the next phase if the outstanding balance hasn’t been paid yet.

- If the estimated costs need to be adjusted for the payment it requires time and attention to the details. These changes have to be documented in the business accounting records. It may be confusing to stakeholders or make them weary about investing in the business.

Completed Contract Method

There are situations where it is not possible to successfully and accurately determine a percentage of completion. Completed contact method is used in this situation. It is done when the project is short and is where it isn’t possible to determine the percentage of completion.

This is also a good choice when your projects can be completed in a short amount of time. Since there isn’t a lengthy lag between when you start and when you finish, there typically aren’t any cash flow concerns. This is also a favourable choice when your expenses for a project are low and you don’t have to depend on profits from that project to cover them.

This method is considered to be conservative, and best used for long-term projects. Sometimes, a down payment is required on larger projects, but that income is still not recorded until the project is complete.

Advantages

- It can result in tax effeciencies due to the delayed reporting of revenue and expenses.

- If the project is completed ahead of schedule, the projected profits from it can increase due to reduced time to complete it and earn the same amount.

Disadvantages

- A dedicated balance sheet has to be kept for each project. This is used to record all of the revenue and expenses for that project from start to finish. This can be a time-consuming process and requires attention to detail.

- It can cause cash flow problems for a business with too many projects not yet paid for. It can also be an issue if your business has high expenses to cover for several projects at once but no income from them coming in yet.

- If the project requires additional time there won’t be additional earnings for it. The overall profit from the project would be reduced.

Installment Method

Not all of your customers are able to pay in full. When you give them other options, it can help generated long-term relationships with them. The installment method allows them to break down the total amount due over a period of time. They will pay a set amount of money each month until the bill is paid off.

With this option, your business will record money as it is paid. For example, if the total bill is $6,000 and they pay you $1,000 for 6 months, you will record $1,000 for each of those months. If a customer doesn’t make a payment there is no money recorded. If they pay extra the total amount they paid at that time is recorded.

Advantages

- Generates sales from customers who otherwise wouldn’t be able to buy from you at all.

- Reduces cash flow problems.

- Increases the probability of return business from previous customers.

Disadvantages

- Additional time is required to track payments and follow up on them.

- Risk of consumers missing payments or not paying the remaining payments due.

- Anticipated income for a given timeframe can be less if payments aren’t made on time by consumers.

- Accounts may have to be sent to collections to receive payments past due.

Final Thoughts

Understanding what each of these revenue recognition methods in accounting offer gives you the opportunity to customise how you record income and expenses for your business. The information ensures you can see the money coming in, overhead expenses, and overall profit or loss. It allows you to see where you are doing well and any weak areas. Avoiding cash flow problems is an important part of successfully operating any type of business.

Related Posts:

- Recording Investment Transactions – 3 Accounting Practices

- The 3 Components of the Balance Sheet Explained

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.