When a corporation is planning to buy a long term asset, different acquisition ways are available, it can be by buying or leasing for example. Generally, leasing is a cheaper option because the payments will be made on instalments allowing the company to maintain its strong cash flows.

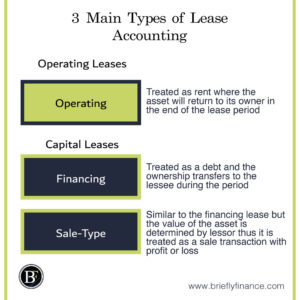

There are three type of leases: 1) Operating leases, 2) Financing leases, 3) Sale-type leases.

In summary, operating leases are treated as rent where the asset will return to its owner in the end of the lease period. Financing leases are treated as debt and the ownership transfers to the lessee during the lease period. The sale-type leases are similar to the financing lease but the value of the asset is determined by lessor thus it is treated as a sale transaction with profit or loss.

I understand that this topic may be confusing specially if it is your first time reading it. In this post my goal is to simplify the concept to get you started with accounting leases.

Before discussing the post let us clarify certain keywords related to leases.

A lessee is the owner of the company that is renting the item from a seller

A lessor is the owner of the asset that is renting the item to the buyer

What Happened? (IFRS 16 and IAS 17)

With the increase in market competitiveness, companies started to be more efficient and the idea of having leases has been increasingly adopted. Not only that, but their accountants have taken advantage of the accounting leasing treatment of IFRS 16 as lessees using operating leases. Below is a quote directly from a IFRS16.

“In 2005, the US Securities and Exchange Commission (SEC) estimated that US public companies may have approximately US$1.25 trillion of off balance sheet leases.”

What the above says is that companies moved their liabilities off the balance sheet through the IFRS 16 operating leases treatment which reduces the loan to equity ratios which can be misleading for investors and creditors.

The IFRS has responded with a new rule which is the IAS 17. IAS 17 is a new rule that forces the lessee to capitalise the asset to ensure that everything is transparent on the balance sheet.

Definitions

Operating Lease

Operating lease can be referred to as renting an asset which usually have short term rental period and the asset will be returned to its owner, the lessor is responsible for maintenance of the leased asset. The salvage value (value at the end of the period) is not zero which means that there is only partial reduction in the valuation of the asset throughout the lease period. Operating lease also is cancelable. By meeting the operating lease conditions the regulators allow the company leasing to keep the asset off the balance sheet.

Because of having these types of leases off balance sheet. Companies prefer to take on operating leases to make sure that their liabilities and solvency ratios remain low.

Below are some typical features of the contract of this type of lease

- The lessee has the right to use the product only and not own it.

- Lessor can cancel the lease and transfer it to another prospect.

- Lessor will be handling repair and maintenance.

Direct Financing

It is like a loan arrangement where the lessee pays instalments along with interest while having ownership of the asset during the period.

The below list is the criteria that would make the lease be a financing lease type. If none of the below criteria were met then it should be classified as operating lease.

- Asset is transferred to the lessee at the end of lease period.

- The lessee can purchase back the machinery below its market value at the end of the lease.

- The lease term is more than 75% of the asset useful life it has to be classified as financing/capital.

- The present value of the lease payment is more than 90% of the asset market value at the beginning of the lease.

Below are some typical features of the contract of this type of lease

- Lessee will own the asset and pay the rent.

- The transaction is similar to giving debt, it is non-cancellable

Sales-Type Lease

It is a lease arrangement where the lessor is assumed to be selling a product to the lessee. It is similar to the financing lease but when it comes to the end of the period the lessor realise both interest income and profit or loss when it comes to the value of the asset at the end of the contract.

To simplify it, the financing lease end of period payment is equal to the book value of the asset. But when it comes to sale type lease the end of period payment can be lower or higher based on the decided selling price thus making a profit or loss in the transaction.

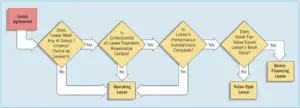

Below is a summary chart that can assist you in differentiating between the lease types.

Chart Source: Intermediate Accounting 15th Edition Kieso Weygandt Warfield

Journal Entries

Here we will discuss the accounting treatments. There will be two point of views the lessor and lessee.

Below is the general recording steps but it may differ depends on the timing of payments, contract and tax treatment.

Lessee Perspective

For the lessee it will always be treated as a financing transaction. Which means the lessee will always assume that there was transfer of ownership to their balance sheet.

Below are how the entries will be:

- Beginning of contract

When a contract take place between two parties regardless of which type it is. It will be recorded as follows.

- Debit: Property – on the asset side of the balance sheet

- Credit: Cash – on the asset side of the balance sheet

- Credit: Lease Liability – on the liability side of the balance sheet

- Depreciation

Throughout the period there should be depreciation because the lessee has to recognize it has an asset on its books.

- Debit: Depreciation Expense – on the expense side of the income statement

- Credit: Property – on the asset side of the balance sheet

- During Payments

While doing payments its recorded as shown below.

- Debit: Interest Expense – on the expense side of the income statement

- Credit: Cash – on the asset side of the balance sheet

- Credit: Property – on the asset side of the balance sheet

Lessor Perspective

As we discussed above, accounting treatment from the lessor perspective is recorded based on three conditions Operating, Financing, and Sale-type leases.

Lessor Entries for operating leases

- Beginning of contract

When a contract take place between the parties it will be recorded as follows, this step will be recurring during every payment.

- Debit: Cash – on the asset side of the balance sheet

- Credit: Rental Income – on the revenue side of income statement

- Depreciation

Throughout the period there should be depreciation because the lessor technically has the on its books

- Debit: Depreciation Expense – on the expense side of the income statement

- Credit: Property – on the asset side of the balance sheet

Until the end of the lease the income will stop and depreciation will continue.

Lessor Entries for financing leases

- Beginning of contract

When a contract take place between the parties it will be recorded as follows.

- Debit: Lease Payment Receivable – on the asset side of the balance sheet

- Credit: Property – on the asset side of balance sheet

- During Payments

Whenever the lessor receives payments it will be recorded as shown below.

- Debit: Cash – on the asset side of the balance sheet

- Credit: Lease Payment Receivable – on the asset side of balance sheet

- Upon Disposition

Upon completion of the contract and transfer of ownership to the lessee it will be recorded as follows.

- Debit: Cash – on the asset side of the balance sheet

- Credit: Gain on sale of leased property – on the revenue side income statement

Lessor Entries for Sale-type leases

- Beginning of contract

When a contract take place between the parties it will be recorded as follows.

- Debit: Lease Payment Receivable – on the asset side of the balance sheet

- Credit: Sales Receivable – on the asset side of balance sheet

Also

- Credit: Inventory – on the asset side of the balance sheet

- Debit: Cost of Goods Sold – on the expense side of income statement

- During Payments

During each lease payment it will be recorded as shown below.

- Debit: Cash – on the asset side of the balance sheet

- Credit: Sales Receivable – on the asset side of balance sheet

- Upon Disposition

Upon completion of the contract if we are expecting to get back the asset from the lessee it will be recorded as follows.

- Debit: Inventory – on the asset side of the balance sheet

- Credit: gain from leases – on the asset side of balance sheet

Final Thoughts

In summary, the concept of leases accounting is large and there is much more to cover. I understand that there are different situations depending on the contract. If you like the post and would still want more information let me know and I will make more content on this topic.

Related Posts:

- Recording Investment Transactions – 3 Accounting Practices

- The 3 Components of the Balance Sheet Explained

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.