Accounting is a skill every individual should be aware of, no matter what the profession. You do not have to know everything. However, understanding the basic concepts, and terminologies of accounting will prepare you to understand how business financials work.

For example, let us say a small business owner had to review an income statement prepared by his accountant. The business owner may end up wondering how come the sales are higher than the actual cash he received? understanding the accrual concept can make significant difference in improving your ability to learn accounting.

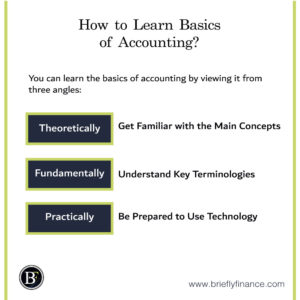

My aim in this post is to address the important concepts, terminologies, and technology that can help you get started.

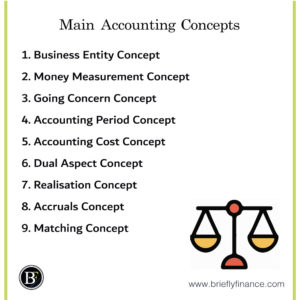

Theoretical: Get Familiar with the Main Concepts

There are certain universal concepts that accountants have in their mind all the time. The accounting concepts list you will look at should give you the basis to answer “why do accountants do their transactions the way they do?”.

-

Business Entity Concept

You have to segregate a business from its owner. Simply put, the business and the owner are two separate entities. For example, if the owner invests a certain amount in the business, it is treated as a liability on the business. Similarly, if the owner withdraws money from the business for personal use; like a vacation or a new car, it is treated as lending.

-

Money Measurement Concept

Everything recorded in the accounting books should be measured in money. There are few special cases where certain items are not recorded in the books which have value for example a brand reputation.

-

Going Concern Concept

This means that the business will continue its activities for years to come. This concept implies that when a business records its purchases it keeps their value on the book and gradually depreciate it. Because the business believes that they will remain in business and do not have to write-off their purchases.

-

Accounting Period Concept

Accounting reports are recorded for a specified period. The accounting period can be a Calendar year or a fiscal year depending on the preference of the company. A calendar year starts on January 1 and ends on December 31. A fiscal year could begin and end within 12 months based on the management preference.

-

Accounting Cost Concept

This concept allows accountants to record their purchases costs at full when they are new. For example, if a company makes a purchase of a machine for making bags that was priced at $785 but paid an additional $250 for transportation and another $400 for installation, the total cost is $1435. The final amount will be recorded in the books.

-

Dual Aspect Concept

The concept states that every transaction has a dual impact on the business. Every transaction is recorded twice 1) from the sources point of view and 2) from the uses point of view.

For example, when a company purchases a car with cash, there are two recordings – 1) Debit: Car Received and 2) Credit: Cash Paid.

-

Realisation Concept

This concept emphasises on the fact that an entry must only be recorded once a transaction has been completed. For example, when a business makes a sale, the profit entry should only be recorded when the money is qualified to be received and the product was delivered.

-

Accruals Concept

When reporting in accounting, revenue and expenses are recorded when realised and not when a cash transaction take place. For example, if a company sells a pre-ordered video game console, it will not record the revenues until the actual product is there and is to be delivered to the customer.

-

Matching Concept

This concept state that the revenues and the expenses incurred during a transaction must belong to the same accounting period. Once revenue is realised, it must match with the relevant accounting period with the expense side. It wouldn’t make sense reporting your spending of 12 months and your profits of 13 months.

If you notice, these concepts work together and make the universal accounting idea of how accounting work in theory. You do not have to memorise any of them, just keep these ideas in your mind when dealing with accounting.

Attribution: The icons has been designed using resources from Flaticon.com

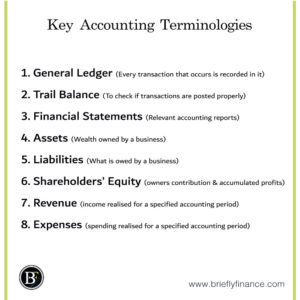

Fundamentals: Understand Key Terminologies

After going through the theoretical part, the following list of the key accounting terms and their definitions can help you get started in understanding accounting fundamentals and be able to start applying accounting.

-

General Ledger

Every transaction that occurs in a business is recorded in the general ledger. In general, It is where you debit and credit all your transactions based on the accounting categories (e.g. Assets, Liabilities, Equity, Revenue, Expense).

-

Trail Balance

A trial balance has all the ledgers which includes both credits and debits of the business with the purpose to check if the transactions are posted properly. The trial balance must balance at the end of the accounting year.

-

Financial Statements

The financial statements are relevant and important for both accountants and any individual related to business. Financial statements include the balance sheet which shows the business financial strength, income statement which shows the business performance and cash flow statement which shows the cash movement of the business.

Financial statements are basically the accounting reports that the related parties want to read (investors, creditors and any stakeholders).

-

Assets (Balance Sheet Item)

An asset is the wealth owned by a business. It includes cash and investments. Buildings, properties, inventory, supplies, and equipment…etc.

-

Liabilities (Balance Sheet Item)

Liabilities are defined as what is owed by a business. For example, a loan or any item that has been bought on credit will be recorded in the liabilities.

-

Shareholders’ Equity (Balance Sheet Item)

It shows how much the company owners contributed and how much it accumulated in profits/losses. The term shareholders equity is used in corporations balance sheets. The equivalent to small businesses is the owner’s equity.

-

Revenue (Income Statement Item)

It is the total amount of income the business realised for a specified accounting period. This includes everything from credit purchases, cash sales, interest incomes, and subscription fees. Keep in mind, revenue figure can be different from actual receipts the business received money from. Any actual cash payments is recorded in the cash flow statement regardless whether they are realised or not.

-

Expenses (Income Statement Item)

Expenses are the costs business generate for operating the business. For example, employee salaries, rent payment, and utility bills. The expenses are recorded when the service is realised which in other words time has passed by and a payment should be made.

With this list of terminologies you already went through all the important ones. I hope now you are ready to get started learning accounting basics.

Practical: Be Prepared to Use Technology

As an extra note, nowadays to practically do accounting well. You will be required to get good with accounting software. I highly recommend you become good with Microsoft Excel initially and then expand to other tools.

To have a feel of how accounting may look like as a career. Check out Wave accounting which is a free online accounting software that you can try out to see what do accountants work on in reality.

Final Thought

Understanding the basics of accounting can be overwhelming at the beginning. I just want you to know that three angles to tackle on the topic: theoretical, fundamental, and practical. Once you are familiar with these three skills you should be on your way to find out where you want to learn more and start making your blueprint.

Related Posts:

- 3 Types of Financial Statements Explained

- The 3 Components of the Balance Sheet Explained

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.