Whenever we discuss economics, we compare it with money. Also, when we hear about finance, the word money comes to the frame. So, does it mean that both finance and economics are the same?

To begin with, finance generally consists of evaluating different types of investment decisions and assessing the financial position from the Individual, Financial Institution, Corporation, or other entity’s point of view.

On the other hand, economics is a much bigger picture. It deals with how different regions, nations, monetary and fiscal policies, or global events function and how they can impact economics, and so on.

Attribution: The icons has been designed using resources from Flaticon.com

How are they related to each other?

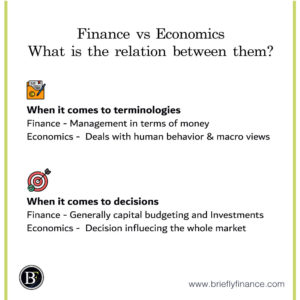

Terminology

Finance – In general, finance means to describe management in terms of money. So, the more you are knowledgeable about finance, the better will be your chances when it comes to managing your finances at both individual and organisational levels.

Economics – “Economics is a separate branch of science that deals with the human behaviour compared to what the relationship between scarce and needs mean with alternative usage.” This is how Robbins used to define Economics.

An example to consider when it comes to relating finance and economics can be seen in the buying process of a car. What happens is that a customer looks at different car models, goes through the reviews online, ask for people’s opinion, and takes a few test drives. This process of decision-making is called economics.

And, the purchasing or actual execution is when the finance aspect steps in. It can be concluded that while they seem to work together, finance and economics are two different things.

Decisions

Finance – It is all about dealing with real monetary effects that relate to certain types of capital budgeting, investments, and other kinds of decisions. Moreover, it deals with how to increase more and more profits by using a variety of tools.

Several types of decision power exist at all levels intended to be applied to different situations and different kinds of products or items. Finance works on product specifications. And, it provides a variety of tools that can evaluate the value of money for a specific time frame.

Moreover, it provides several competitive methods to bring out the best value to the money depending on a variety of factors. It exists at different root levels of an economy and that includes a household as well. It is called personal finance management.

As a result, financial decisions are taken and can make minor changes within a said time frame for either a corporation or an individual to maximise guaranteed returns.

Economics – It deals in creating, making minor changes, or determining certain policies that might impact a whole market and concerned industries regardless of any level.

And, the legal institutions or government makes the decision.

Economics tends to provide strategies and theories that help to develop the framework that is needed by any sector, industry, or company, with a much broader aspect in terms of monetary policies.

Economics tends to exist even at high levels. However, the decisions made can impact the whole economy, application, and existence lies at the grass level.

Moreover, decisions related to the economy cannot be changed easily and they need a higher level of research and analysis. This is because they can adversely affect the entire economy regardless of a specific section.

Education Path

In general, education in both economics and finance start with a bachelor’s program which consist of some common courses such as mathematics, statistics, global business, and business fundamentals with some emphasis on the main topic.

Also, both the disciplines include technology courses. Finance undergraduate degrees include several theories concerning economics whereas economic degrees consist of courses in certain areas such as accounting and taxation that are treated as finance specialisation.

However, there are certain benefits from specialised degrees. The degrees allow them to align their career goals with their studies. For example, MS in Economics depends on econometrics. It means students who aspire to work in the research & programming branches of Economics are benefited from the critical thinking and quantitative analysis that the degree offers.

Students who are interested in economics in policy-making can add more ethics and communications courses. Whereas, MS in Finance offers many tracks that feature specialisations. Students, for example, might earn a Master of Science in Finance for the international business track along with a corporate finance specialisation.

Career Path

Imagine yourself as a finance expert and working in a specialised field, say Credit Analysis, Equity Research, Banking, Portfolio Management, or Wealth Management. Now, you should have a better understanding of a variety of economic parameters alongside how they interplay with both national and global events.

And, how they may have an impact on financial investments or businesses that are being analysed. It is like understanding a certain parameter on one hand and understanding the other parameter at another hand.

In the same way, if you like to pursue a career in Economics, having a good understanding of how the Banking sector and Financial Markets function including certain aspects of financial concepts such as capital structure, risk analysis, time values, and so on helps you to analyse researches more holistic.

Here is a link that highlights of Occupational Employment and Wage Statistics from US Bureau of Labor Statistics that may interest you with the average salaries.

Final Thoughts

In conclusion, finance is an integral part of economics. Finance and economics are not related to each other because finance involves how an individual or business becomes more prosperous economically so that you can make the best out of their money.

However, finance, in some ways is related to economics. It helps you understand how the market works and that can impact investment decisions.

Related Posts:

- 3 Types of Financial Statements Explained

- 5 Key Limitations of the Balance Sheet

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.