Most of us refer to public investments when talking about investing. But it is not the only type of investing you should consider. For example, buying collectable sports card that could increase in value due to its rarity can be an investment option to which is called alternative investment.

Alternative investments characteristics differ from the traditional investments in terms of their liquidity, complexity, costs, regulations, transparency, and mode of fund management.

Before discussing the characteristics, the next paragraph is a quick recap about alternative investments.

What are Alternative Investments?

Alternative investments also referred to as “alternatives” or “alts” are those financial assets that do not belong to the traditional investment category which are like publicly traded stocks and fixed income instruments.

Financial assets that are classified as alternative investments include hedge funds, private equity or venture capital, exchange funds, commodities, managed futures, derivatives contracts, and tangible assets such as precious metals, wine, stamps, coins, arts, and antiques. However, in some cases, real estate can also be classified as an alternative investment.

Because this is completely different from the traditional and popularly known investments. For this reason, I have taken out time to explain below some characteristics of alternative investments and how they can influence investor decisions either positively or negatively.

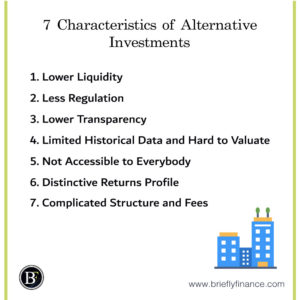

7 Characteristics of Alternative Investments

Alternative investments have become more popular in the last decades than it ever was. Based on a survey conducted by Preqin in 2018 alternative asset industry is expected to reach $14 trillion compared to $3.1 trillion in 2008.

More people are looking for other means to invest their means outside the traditional modes of investments. While these alternative investments have yielded great benefits, it is important for you to know some of the characteristics of alternative investments.

-

Lower Liquidity

Unlike traditional investments, alternative investments have lower liquidity levels. The reasons for this is because there is an absence of centralised markets, and low demand among others. For example, when investing in private equity, you should be ready to face a very complicated liquidation process and also you may encounter a challenge to find a buyer.

-

Less Regulation

Majority of alternative investments out there have little or no regulations governing it. Regulations can be both positive and negative on investments, the less regulation can help you operate and actively be involved with your venture. But it also means that you have to be very careful in choosing the right asset manager.

-

Lower Transparency

A chief characteristic of alternative investments is how low transparency. Considering that many of these alternative investment platforms and methods are without a central structure, transparency is very low. Closely related to the issue of transparency is that of the unpredictable nature of these investments. What this means is that the outcome is not certain as it can go either way – positively or negatively.

For example, you may find a private equity company with great historical performance that is attractive to invest in. But when it goes to the due diligence stage you may realise that the CEO wants to sell the company and resign because he is expecting the industry to stop growing that the public are unaware of.

There are many hidden aspects which require careful exploration when investing in alternative investments.

-

Limited Historical Data and Hard to Valuate

When investing, you have to ensure that you are well-informed. With the right information, you can make better investment decisions both on a short and long-term basis. Sadly, many alternative investment have limited historical data that validates their credibility and give you the trust you need to invest.

The limited historical data along with lack of transparency can result in an unreliable valuation. At the end of the day the investor wants to invest in an asset that is reasonably priced with expected high returns.

-

Not Accessible to Everybody

Another characteristic of alternative investment I would like to point is its limited availability. While these alternative options may have higher returns compared to the traditional investments, they also require a high entry price. This entry price can start with one million dollars per ticket and even if this amount was affordable an investor with minimum entry price ticket will not have all the privileges of benefiting from being an active owner in the investment.

-

Distinctive Returns Profile

When investing in a public company, it is easy to expect their dividends and be able to see the stock price to calculate your investment returns.

With alternative investments there is a varied flow of returns. For example, if you invest in a venture capital you may expect a 10x return on your money when the company is ready to be public. Where in reality you may return way more than the amount or less depending on the investment performance.

However, the good thing about alternative investments is it provides diversification to investors. As you know, public market shares usually expand and collapse all together based on the market sentiment. However, alternative investment has no correlation to the market and is more related to the actual performance and demand on the asset itself

-

Complicated Structure and Fees

Last but not least, alternative investments set up structure can be confusing. That is particularly for private equity and hedge funds. The investor money is going to be invested through a special purpose vehicle (SPV) indirectly in an investment. These structures are used for tax efficiencies, operational treatments and also to provide certain investors special treatments.

Along with the complicated structure there is the complicated fees. Unlike public companies that would charge you brokerage fee and annual fund management fee. Alternative investments provide multilayers of fees of brokerage fees, arrangement fees, management fees, performance fees, and other fees (if necessary).

Above characteristics of alternative investments can make an investor intimidated and do not want to invest. In reality, most investors invest their money after in-depth due diligence and from building trust with the asset manager.

Final Thoughts

In summary, alternative investments are good for the diversification and high returns. Yes, assessing the investment, its structure and the associated risk might is difficult and can be intimidating. Just make sure you do your careful research and choose your investment wisely.

I hope you find the post beneficial. I didn’t get into much details in this post because my goal was to make it introductory on the topic. Let me know if you want more on this topic.

Related Posts:

- Must Have Value Investing Books for Beginners

- Money Mindset Books to Grow and Maintain Your Wealth

- Practical Investing Books You Should Read

Disclaimer: Above links below are affiliate links and at no additional cost to you, I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful, not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.