After reading dozen of investing books to help me become a better investor. I noticed that investment books have different angles when it comes to their approach. For example, they could discuss money mindset, investing fundamentals, technical analysis and much more.

In this post however, I want to focus with you on the practical books that I recommend.

These three practical investing books I recommend will help you understand the fundamentals in valuations and approaches for looking at the stocks from different point of view.

Let us look at them…

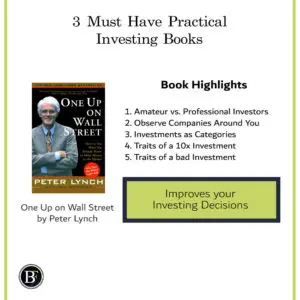

1. One Up on Wall Street

One up on wall street is written by Peter Lynch, he is the vice chairman of Fidelity Management and Research company with a successful annual return of 29.2% under his leadership from 1977 to 1990.

A $10,000 invested with Peter back in 1977 would make you $279,500 in 1990.

This book is an easy read that have a mix of practical tips and nuggets of his experience. For me, this book is the most entertaining amongst the three. I enjoy how he transition from sharing useful investment terminologies and how he brings up real life example.

Along with the valuable experience over Peter’s long-term investing career, the book encourages individuals that they can perform well in the stock market and do better than professionals.

If you are experienced investor, you may get less value as some fundamental concepts are repetitive. But I am sure you will get away with the book specially when it comes with the examples he brings up.

Book Highlights

- Amateur Investors Advantage Over Professionals

Professional investors are usually constrained with circumstances when investing on behalf of their institution/client.

Their decision making process may require a long, their investors’ have unique criteria, they are forced to focus on the short-term services, and they have to play it safe with others money to keep their job.

Peter discussed that due to the challenges professionals face the amateur investors have an advantage. The amateur investors have the flexibility and time to invest before the stock price is influenced by larger players in the market.

- Observe Companies Around you

Recognising a company in your area or a product you actually use will give you an unseen advantage in analysing a company.

If you like the product you may also like the stock.

Investment does not have to be all about reading from annual reports, you may find something you know about or tried that have great potential where other investors did not realise yet.

For example, if you are into gaming you would know which gaming publisher is doing well in comparison to an analyst who never played the games and is reading from an annual report.

- Investments as Categories

Peter will share with you how he categorises investments and how he deal with each ones situation.

The list will include:

- Slow growers

- Stalwarts (means they have medium growth)

- Fast growers (more than 20% growth a year)

- Cyclical (they rise and fall through business cycles)

- Turnarounds (Companies are about to fail but could survive)

- Asset plays (Assets of the businesses more expensive than the share price itself)

He will explain to you how he deals with each category. Which are safe, which are risky, which makes good returns…etc

- Traits of a 10x Investments

He explains the common traits that would make an investment grow 10 times or as he calls them tenbaggers.

Tenbaggers include: 1) A boring company name 2) Boring industry 3) Disagreeable product 4) Not discovered or preferred by institutions 5) A depressing product/industry 6) Industry is not growing 7) They have unique competencies 8) Recurring revenue 9) Insiders are buying 10) Company is buying back shares.

Above is an idea on what you expect to read about the traits that make an investment 10x profitable. The author will explain with examples on why each trait is a sign of a 10x growth company.

- Traits of a bad investment

Peter Lynch will also talk about the opposite traits that you don’t want to see in a company.

It includes: 1) A hot industry 2) It is the “next” big thing 3) The company is expanding to unrelated sectors 4) Depending on few large clients 5) The companies claim to do something too good to be true.

As you noticed the book have lists of categories and ideas that could work as a checklist when looking at an investment.

What is unique about this book is that it doesn’t just have these lists. The author share his experience with examples followed by the performance of the stock he described.

This makes is to have practical ideas on looking at investments and acquire experience from one of the best fund managers ever.

To get the book from Amazon Click Here

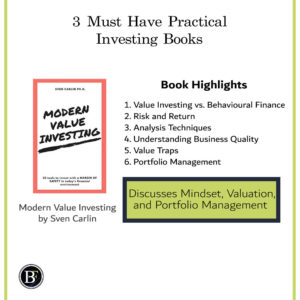

2. Modern Value Investing

I have found out about this book from watching Sven Carlin (link to his website) on YouTube. He is an independent investment researcher and has a Ph.D. related to risk. He is one of the people that influenced the way I look at investing.

He is not about getting rich quick, but he always focus on low risk and high returns.

It is a simple book to read and I find that the available tools it has can be a good step by step guide to take when investing .

The early part may not be very practical but still is mindset preparation. Later on, you will go through practical information from individual stock picking tips to building a portfolio.

Book Highlights

- Value Investing and Behavioural Finance theories

The book will talk to you about the psychology behind investing, the difference between investing vs. speculation, and how value investing mentality beats growth investing.

Sven emphasises that investing is for the long-term, and the importance of being rational without being influenced by others nor the market fluctuations.

He discusses the psychology behind prospective theory (how we are attracted to high gains), and loss aversion theory (how we naturally want to avoid risk).

- Risk and Rewards

He discusses the concept that what we studied in our education system about higher risk mean higher return is not always true.

Risk to value investors is the risk of permanent loss of capital and is not about the market fluctuations.

- Analysis Techniques

When it comes to quantitative techniques, the author addressed the importance of minimising your mistakes through proper valuation and other tools that help you in your analysis.

He will teach you about finding the intrinsic value through Net Present Value (NPV) calculation and through the liquidation method.

Sven also discussed the methods for calculating the margin of safety and many other techniques.

- Understanding Business Quality

On the other hand, when it comes to qualitative techniques, Sven have discussed several indicators to recognise that shows the business is uniquely positioned and is hard to get out of business.

Like: 1) Being a low cost provider 2) It is expensive for clients to change the service, and 3) Government support…etc.

Additionally, he will discuss other qualitative methods including analysing the management, checking the quality of earnings, and investing through sector cyclicality

- Value traps

After knowing how to do valuation and understand attractive business, Sven talks about the value traps when selecting an investment.

Even if the company is attractive to invest it, there are some factors other factors to look at. For example, is the business able to continue its growth in the future? And How?

Other question to check, is the industry growing? What is the quality of assets in the balance sheet? Is the management buying shares?

- Portfolio Management

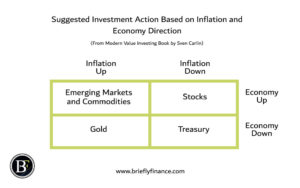

This section expands about how an investor can achieve higher return with lower risk.

Sven discusses how a good portfolio lowers overall risk and also talked about how value investor occasionally trade to balance the portfolio.

Other aspects that could affect the returns including the inflation and economy. Where he advised when to invest in each situation.

Overall what you can get from the book is value investing mindset, practical ways for evaluating companies, and portfolio/risk management advise.

To get the book from Amazon Click Here

3. The Little Book of Valuation

The author of this book Aswath Damodaran is a professor of finance at New York University. He is one of the well-known finance teachers on valuation.

Reading his book is ideal to introduce you to the key finance concepts and methods around valuations.

Company valuations will help you answer the question “How much am I willing to pay to this stock?”

Reading the book may not be very easy for someone who have no finance background at all. But I would still encourage reading it.

Despite the technicality, if you want to know how to value the price of a stock then this book is for you.

Book Highlights

- Introduces you to Key Finance Topic

The book will start discussing key topics that matter to finance, like time value of money, concept of risk and financial statements.

A notable term Aswath will discuss is the free cash flow on its different calculation methods. Free cash flow is a must learn term for any who is planning to be in the finance. This information from the book makes me think is enough to buy it.

- Two approaches for valuation

The two valuation methods discussed were comparable analysis (refers to relative value too) and the intrinsic value.

The author will describe the importance of similarity of the company size and industry it is in when doing the comparable analysis. Aswath will also discuss how variables like price to earning and expected growth are related to the analysis

When it comes to intrinsic value, he will explain how to find the company valuation through the discounting cash flow method and other tips like estimating the growth rate in the model.

- Flaws of Valuation

He will bring up the idea that valuations have biases. The author will describe how analyst may have bias in their decision despite all the dedicated research that was put in.

- Guidelines on investing based on the Context of the investment

The author will give some guidelines when investing based on the investment situation.

Whether the business is cyclical, scalable, stagnating he will share different method when investing.

For example, If a company can with strong balance sheet and can survive economic challenges is valued differently from company that may have higher growth potential and weak balance sheet.

Another example, when doing valuation for a cyclical company which means that their earnings fluctuate in every cycle. The ideal way is to look at the average and normalise the earnings instead of taking the figure showing to date.

In summary, if you are interested in understanding and doing valuations this book is for you

To get the book from Amazon Click Here

Final Thoughts

I find these three books are very practical for investing. They may not be purely a “checklist” type of books. But they have enough information to make an investment checklist and they also provide guidance when investing in various different situations.

Related Posts:

- 3 Must Have Value Investing Books for Beginners

- 3 Money Mindset Books to Grow and Maintain Your Wealth

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.