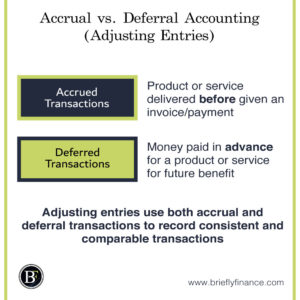

I understand that accrual and deferral entries in the financial statements seem confusing to read and record. Accrual and deferral entries are just adjusting entries. Their purpose is to make reading accounting transactions consistent and comparable.

In general, any accrual transaction means that a product or service have been delivered before it is invoiced. While deferral transaction means money has been paid in advance for a product or service.

Accrued means payments have not been done yet, deferred means payments were made in advance. The rest of the subject relies on how you interpret each transaction by itself through having strengthened your accounting basics.

Why Adjusting Entries Matter?

Accounting is prepared on accrual basis, which means accountants are required to record transactions as they incurred and not just when there is a cash transaction.

Recording the statement is usually done in the end of the month. And what happen in reality is that payment flow between the buyer and seller is not perfect. That is why accrual and deferral adjusting entries are necessary.

The purpose is to make the company financial statement consistent and comparable through monthly adjustments. Doing adjusting entries will make the company avoid large cash transaction impact and will allow the reader to see the company performance reasonably.

Let us go through various situations one by one to have a full idea about the adjusting entries.

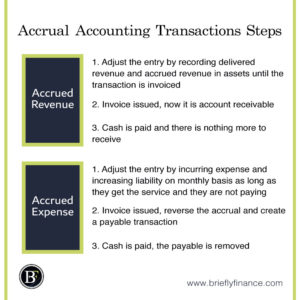

Accrual Transactions

Accrued transaction refers to receiving a product or a service before paying cash. These are the transactions you will see when cash is to be paid in the future.

If you see accrued revenue in the assets side of the balance sheet it means that the company already did the service and should get the money for it.

If you see accrued expense in the liabilities side of the balance sheet it means that the company is required to pay money in the future for that service.

We will further discuss them below.

Accrued Revenue

To accrue revenue is when a company deliver a service to the customer but did not receive the cash nor issued an invoice.

Bookkeeping Example

Let us say a private teacher taught his student, the student forgot to bring the money and the teacher decided to take the money next time they meet up.

Also the teacher was busy and did not issue an invoice too.

-

Accrued Revenue Adjusting Entry

The month has ended, and the accountant want to record the transactions. As you know by now accounting always report earnings even when there is no cash transaction yet.

The accountant would do the following entry

- Debit: Accrued Revenue – on the asset side of the balance sheet

- Credit: Revenue – on the revenue side of the income statement

This transaction shows that the teacher has reported that he will make revenue in his income statement. Even if he did not receive actual cash nor issued an invoice. He was still able to increase both his revenues in the income statement and accrued revenue in his asset side.

-

Invoice is Issued

The teacher then issued an invoice. The purpose of the invoice is to remind the student to pay the money.

The transaction then will be recorded:

- Debit: Account Receivable – on the asset side of the balance sheet

- Credit: Accrued Revenue – on the asset side of the balance sheet

As you can see the transaction here was just adjusting back from accrued revenue to actual account receivable. The purpose of doing that is to indicate in the statements that this amount is invoiced, tracked and should be collected.

-

Cash is Paid

Finally, the student has paid the money to the teacher.

The transaction will be recorded as shown below.

- Debit: Cash – on the asset side of the balance sheet

- Credit: Account Receivable – on the asset side of the balance sheet

The last step will just be an indication that cash is now increased and there is no money to be received anymore.

Accrued Expense

When it comes to accrued expense, It is an expense that is generated because a product or service was delivered to the company which has not been paid yet nor invoiced.

Bookkeeping Example

Let us say a company has a contract with a cleaning service provider where they should pay once every quarter (every three months).

-

Accrued Expense Adjusting Entry

After end of the first month the accountant is going to record the bill even if they did not actually pay it.

The transaction will be.

- Debit: Cleaning Expense – In the expense side of the income statement

- Credit: Accrued Expenses – in the liabilities side of the balance sheet

This means that the company have recognised the one month expense because it will take money from the business in the future. It also means it is a liability now until it is paid.

This transaction will be repeated and accrued two times in this example. Once every month.

-

Third Month

Once the amount is required to be paid which is on the end of the third month as the invoice will be issued. This means that we first need to reverse our last two adjusting entries and then expense it as payable.

The accountant will record the transaction as shown below.

- Debit: Accrued Expense – In the liabilities side of the balance sheet

- Credit: Cleaning Expense – In the liabilities side of the balance sheet

We first reversed the transactions we accrued last two months.

Now we can record the new payable as we have our invoice.

- Debit: Cleaning Expense – In the expense side of income statement

- Credit: Account Payable to Service Provider – In the liabilities side of balance sheet

Doing these two transactions adjusted the entries back and properly shows that there is account payable to be made.

-

Cash is Paid

Once the company decide to pay they will pay out their liabilities as shown below.

- Debit: Payable to Service Provider – In the liabilities side of balance sheet

- Credit: Cash – In the assets side of balance sheet

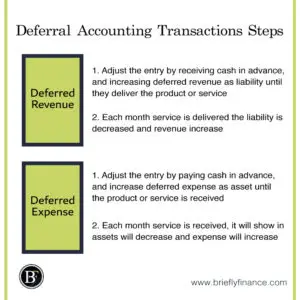

Deferred Transactions

Deferred transactions are prepared when cash payment is made in advance before the product or service is completed.

If you see deferred revenue in the liabilities side of the balance sheet it means that the company received money in advance and should deliver a product or a service for it.

If you see deferred expense in the assets side of the balance sheet it means that the company has already paid money in advance and expected to get a product or service from the seller.

Let us look at each separately.

Deferred Revenue

It is the money a company receive in advance before the company actually complete the delivery of product or service to the customer.

For example, if a company received a payment for one-year subscription service. The amount can’t be recognised in bulk as revenue because the business didn’t actually deliver the service yet. That is why it will gradually get recognised in the revenue every time the service is delivered.

Bookkeeping Example

Let us say a marketing consultancy company received payment for a service, they will provide for the next quarter (three months).

-

Deferred Revenue Adjusted Entry

Once they receive the cash in advance the accountant will record it as following

- Debit: Cash – In the assets side of the balance sheet

- Credit: Deferred Revenue – In the liabilities side of the balance sheet

On this step, the company has increased its cash balances but also considered the amount as liability because it has obligation to do the service.

-

After Each Month Until End of Third Month (in our example)

On each month end, after providing the service the accountants would do the following

- Debit: Deferred Revenue – In the liabilities side of the balance sheet

- Credit: Revenue – In the revenue side of the income statement

Now after each month is passed and services are being delivered, you will reduce the obligation every month.

It will also add up to the revenue now because it has been completed.

Deferred Expense

Deferred expense refers to prepayments for services a company is going received in the future thus it should also be expensed in the future.

if a company paid for a long term consulting service, let us say it is for 5 years, it would not make sense counting the full amount as an expense in the income statement.

Bookkeeping Example

A company decided to subscribe to social media management service where they should pay money 3 months in advance.

To make sure they do not expense all three months work in the first month they will be doing their adjusting entries.

-

Deferred Adjustment Entry

Once the cash is paid in advance the accountant will record the following:

- Credit: Cash – In the asset side of the balance sheet

- Debit: Deferred Expense – In the asset side of the balance sheet

The cash has been paid and will leave the balance sheet, because the service provider is obliged to serve the company then it will show that deferred expense is also an asset.

-

After Each Month Until end of the Third Month (in our example)

Every time a month passes while the company receive a service, the accountant will record the following.

- Debit: Marketing Expense – In the expense side of the income statement

- Credit: Deferred Expense – In the balance sheet side of the assets

After each month a service is completed we can expense the marketing fees gradually in the income statement. On the other hand, the deferred expense from the asset is also going to be gradually reduced because the marketing consultant obligation is also reduced.

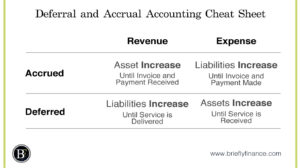

Quick Tips to Remember the Concept

I understand it may still be confusing, when you see an adjusting entry take a pause and do the following:

-

Ask yourself “did the money got paid or not?”

If money is paid first then it is deferred (to remember: Deferred start with letter D means “Don’t worry payment is done”)

If money did not get paid then it is accrued (to remember: Accrued start with letter A means “Ah! I need to pay”)

-

Think if the transaction was an expense or revenue

You may encounter different terminologies like tax and interest. Just take the time to see is this transaction supposed to take money from the company or adds money to the company.

-

Start classifying it

Just use this cheat sheet,

Final Thought

It was challenging to make this post, but it has been done now! I would be happy to know whether you find it easy to follow or there are still improvements required. If you still want to read more about the topic I recommend to check out Investopedia’s post about the same topic.

Please don’t forget to share the post to someone that needs help with adjusting entries.

Related Posts:

- Recording Investment Transactions – 3 Accounting Practices

- The 3 Components of the Balance Sheet Explained

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.