In my early twenties when I started working, I was pretty bad with money. I know I wasn’t alone in that path, which is why I put together this list of financial tips that I wish I could have given to my younger self.

In a nutshell, I was spending more than I making and that is it. If you get this idea out of the post it is probably enough. Save as much as you can, spend less than you make.

You do not have to be stingy. After all most of us want to life a comfortable happy life. Money won’t be with us after we die. But living short of money because of instant gratification by buying multiple things is also not a smart way to manage money.

Attribution: The icons has been designed using resources from Flaticon.com

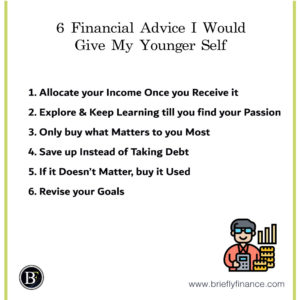

6 Financial Advice I Would Give My Younger Self

-

Allocate your Income Once you Receive it

One of the best things I started doing was having automatic transfers from each paycheck into different accounts. I would try to set up this process months in advance so that I could budget based on what I had been able to save up. My goal was usually percentage of whatever amount of money the savings account was earning each month.

To be more precise you can allocate your income into different categories, here is an example (adjust based on what is important to you) 20% saving, 10% investing, 10% charity, and 60% will cover your day to day spending.

The money you save every month can be a large lump sum over the years and with some investing you will be ready to set up your life for recurring passive income and being financially stable.

-

Explore and Keep Learning until you find your Passion

Instead of looming on the fact that I wasn’t making enough money, I should’ve been continuously learning and exploring.

At early stages of your career, try many different things, focus on learning and if you find something you are really passionate about and it makes money congratulation you have won.

But let us be realistic, some of us may have passion that does not make money (not because it is impossible, we just do not want to make money from our passion).

You have to decide whether 1) Finding a job that can make you money and enjoy your passion on the side, or 2) Go all in to your passion and if it makes a lot of money you will be wealthy. In general, you may compromise your wealth that way but at least you are doing what is right for you.

To clarify this point, do not stick with a job that you do not like (in the long term) and always keep in mind to consider your happiness as part of your wealth building plan.

After deciding what you want to do at age of 30? 35? Or maybe 40? It is time to stick to it and stay committed. It is almost impossible to find something that you would enjoy 100% of the time and make you money, life is hard. Therefore, being committed for the long run on your plan for 10 to 20 years will set you up in a good position.

-

Only buy what Matters to you Most

Another area I wasted money in was when I went to buy stuff that I would eventually not use. When you are young, it’s easy to want the latest products like gadget or clothing all the time.

If I were to go back, I would still spend money on things that I “really” need and be very picky on things that I don’t. For example, you may like to buy an iPhone and a MacBook then its fine buy them, but do you also need to buy high-end branded clothes?

Ideally it is better to spend what you like and do not spend on what pleases others.

-

Save up Instead of Taking Debt

I know this is a hard one, but keep in mind whatever big purchase you will make with debt whether it is a house, college tuition, a car, or anything on instalments. You are setting yourself up to work for the contract time period which could be years.

I do not believe it is worth being in any contract specially if at some point in your life you just want to leave everything and relax which won’t work if you are dealing with a loan.

There has to be recurring costs in everyone’s life. It is just reducing it as much as possible will allow you to be more flexible and have less stress in your life.

-

If it Doesn’t Matter, buy it Used

For example, if you’re going to purchase a car, why not buy a car that was well maintained by someone else? New cars depreciate the second you drive them off the showroom – that’s not an investment, it’s a liability.

This rule also applies for any products, let us say you are not into gadgets and you do not consider it important, but you have to buy a laptop. Why not get used one instead of new one? The extra money can be invested and used in other items you really want to buy.

-

Revise your Goals: It is not Always about the Money

Also, another thing, excessive money is not always the route to be happy in life. As Tony Robbins say “progress equals happiness”. Happiness is a mix of our expectation of what we want in life and how we are progressing towards it.

When income does not matter to you at all and you want to work least number of hours possible then just go for it. Just remember to save up for emergency when it occurs.

But If you are after the money and financial freedom then do that. And keep in mind It is most likely not going to be easy and you will probably spend countless of hours working and missing out on other life activities.

Final Thoughts

Financial tips are many, but in this post I focused on key reasons of what really have influenced the way I think of money and I hope it makes difference in your life too.

If you like to read more content about wealth mindset, check out this post where I summarised three money mindset books.

Related Posts:

Disclaimer: Above links includes affiliate links and at no additional cost to you, I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful, not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.