You may heard experienced investors say “it is all about the cash flow”. Analysing cash flow statement is an important skill. In fact some investors do not even want to look at the income statement as a performance indicator and just analyse the cash flow statement.

Before jumping into the steps to analyse cash flow statement, here is a quick recap about it. You can skip this part and dive in to the 4 steps if you already know about it.

Quick Recap

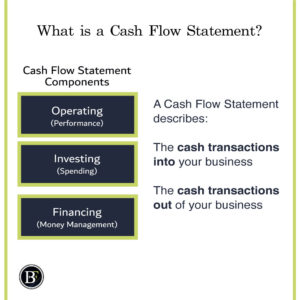

A cash flow statement describes how the actual cash is moving in and out of the business.

There are 3 components of the cash flow statement:

- Operating activities

- Investing activities

- Financing activities

There are two methods for recording it. The direct and indirect method. We will analyse the indirect method here because it is the most commonly used.

If you are interested in reading more check out the link to Investopedia

Just remember that the indirect method starts with the net income the bottom-line item of the income statement. Everything else we will discuss below are the adjustments from the “net income” figure to actual cash.

-

Operating activities: how profitable and efficient is the business?

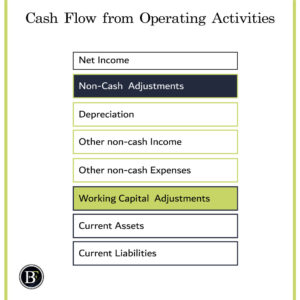

The first component of a cash flow statement is the cash flow from operating activities. This section in general will tell you how much actual cash this business activities generated.

To analyse this section a good approach is to divide it in two halves. First part is the one that talks about the profitability or non- cash adjustment of the business and the other is about the efficiency or working capital adjustments.

Profitability (non-cash adjustments)

This will include the first few lines in the financial statement that adds back non-cash deduction that occurred to the net income.

These will mainly have depreciation expense, Other income and other expenses that are non-recurring or involve capital gain.

Summing up the profitability section can help you answer the question “does this business generate good money?”.

Efficiency (working capital adjustments)

The second part of the operating activities represents the changes in working capital. They are the line items that are usually in the current assets and current liabilities from the balance sheet. It includes items from account receivable, inventory, account payable.

Understanding this part will give you an idea on how efficient the business is dealing with the money they have. Are they able to maintain cash balances from their transactions between their customers and suppliers?

Now after looking at the cash flow from operating activity you have a sense on how the business is performing and generating cash.

-

Investing activities: what are they Investing in? Is it relevant for the short and long Term?

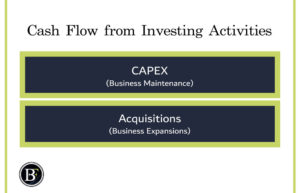

The second steps is to see the business investment decisions. Are they taking wise decisions to maintain and grow the business?

For this section, there are two key items to look for which are the capital expenditures (Business maintenance for steady growth) and the acquisitions (investment for future growth).

Capital Expenditures

These are the spending used by the business to maintain the long-term assets. For example it could be building maintenance, building new facility, and you may also see it as purchase of equipment and property.

Capital expenditures differ from industry to another, but when analysing cash flow statement and seeing that the capital expenditure is being spent sustainably and reasonably you should expect that the returns growth to also be the same.

Capital expenditure is an important line item to look at and take a pause when analysing the cash flow statement. Think about are they maintaining the business the way they should be?

Because at this point you have already created a story about how the business is generating money and managing it. This part is how they are spending it to maintain that income.

Acquisition

Another spending a business makes is the acquisition. This section may not have direct impact on the short-term earnings of a business.

Acquisitions will record the amount a business pay to buy another business. If you see this figure is high you may want to explore what did the business decided to buy? is it worth it for the long term?

In general reading this line item will give you idea how much is the business is investing for the long-term. For example, let us say back in 2006 Google bought YouTube for $1.65 here is a link to theverge for your reference.

The impact of Google acquisition of YouTube was not seen in the short run, but looking at it today, YouTube is generating more than 15 billion in revenues for Google every year.

Just keep in mind a negative cash flow from investing activity is not always bad. Specially if you are seeing a company is investing for the short and long term future.

-

Financing activities: where they get their money from? what are they doing with it?

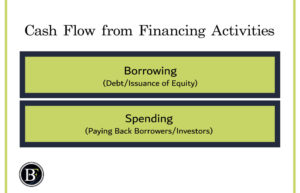

The third step is to look at how did the business deal with their lenders and shareholders. In general it will show an indication to you how is the business is dealing with money.

It will include the borrowing and how much they are giving away to investors. This section may require personal opinion when it comes to the analysis. It can give you a strong insight on how the management think which is important to know before deciding to invest in them.

Debt proceeds

It will show the loans the company has received. When looking at debt in general, try to figure out “why did the business decided to take a loan?”.

Here are some scenarios taking debt which are to:

- Do acquisitions and increase the size of the business

- Be more efficient

- Pay back investors money

- Meet other obligations

If you see the debt has been a significant amount. Consider spending some time exploring the business intent.

For example, taking debt to pay back investors can be positive if the business is confident and has good cash flow. But if they are struggling and doing that, this means they are mismanaging and prioritising short-term investors needs.

Principal of loan paid

It is paying off the debt principal amount. This principal amount paid refers to the loans in the liability section of the balance sheet. It is not the interest from the income statement.

You may want to think “is paying off debt now make sense? Would it be better to do that or reinvest the money? Or maybe pay the investors?”

Issuance of Equity

It means that the business raises capital from their available authorised shares. For example, let us say a business have two owners with two shares owning 50% each. If the business decided to bring in a new equal partner they will issue a third share. Everyone will have 33% each.

It is true a third partner will not join for free, he will increase the cash inflow for the business. But when analysing you may think “does this business keep issuing shares and reducing ownership of existing owners? Is it growing fast enough to satisfy that ownership reduction?”

Share repurchase

Share repurchase is the opposite of issuing equity. Buying back shares increases the ownership value to investors by buying out existing investors that want to exit.

Usually share buyback is good when a business believe that its stock value is underpriced and they want to increase the returns per share to investors in the future.

Just make sure to explore the management intent with this decision. Could it be the CEO is buying back shares to increase his compensation by increasing the stock prices through purchases?

Dividends Paid

Paying dividends to investors means basically distributing cash to investors. For you as an analyst, you may want to see the maturity level of the business. did the business reach a stage it can’t grow anymore and should distribute money to their investors?

Or are the management spending the money where they could reinvest it to maintain or grow the business size?

The cash flow from financing activity may not seem important because it is not related to the business operations.

In my opinion, I think it is very important reason to know whether you want to invest with them or not. Financing activities can make you see the realty of the business. Are they the type who save money frugally or are they who spend money?

Both approaches could work but when you mix it with the actual business performance story it will make more sense. For example, if a business operation is doing very well and they are taking debt to pay off their investors dividends can be a good sign. But if a business is doing bad then this could turn off investors.

-

BONUS STEP: Free cash flow, how much cash the business generates to investors?

You will not see a component called free cash flow in the cash flow statement. But this could arguably be the most important item among all the financial statements.

Ideally the bottom line of any analysis is we want to know. How much cash the business is really gong to make for me as an investor? this is what free cash flow answers.

Free cash flow is not just an answer to the question about how much money a business can generate. It is also used by analysts who prepare discounted cash flow financial models which are projections to come up with the business value today.

In general to calculate the free cash flow, we will take money generated from operation activities and deduct the capital expenditures. Some analysts may want to deduct the interest paid to banks to see the free cash flow for the shareholders themselves.

To read more about different ways of calculating free cash flow click on the link for corporate finance institute.

Why is this metric important? Because it is the remaining money the business will decide to either distribute to their investors, make more acquisitions, or pay off their debt.

Analysing free cash flow will allow you to decide whether the business is a cash machine or it is not and need to find a way to generate more cash to survive.

Final Thought

As a general note whenever making any financial statement analysis, if you are a simple-minded person like myself. Just take each section and think about it carefully “how can it impact the business? Is it good over the years? What are the competitors numbers?”.

You will be amazed how you can understand the statements.

If you are a sophisticated financial analyst, I hope you slow down with the ratios little bit you may find some insight you didn’t think of before and that would not relate to any ratios.

Also let me know guys if you want us to go through a cash flow statement that is built using the direct method.

Is there anything I missed in the post? Please let me know and don’t forget to share it!

Related Posts:

- 3 Types of Financial Statements Explained

- The 3 Components of the Balance Sheet Explained

- Common Components of Income Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.