When it comes to traditional investing the markets are very efficient and lacks discrepancy most of the time. On the other hand, both cryptocurrencies and NFTs (Non-fungible tokens) are still in their early stages and are not efficient when it comes to pricing thus creating opportunity for buyers to make substantial income/losses.

In this post we will talk about the difference between the NFTs and cryptocurrencies. I am assuming you already have some idea about each of them.

Cryptocurrency is a digital currency issued in a private system, it is not regulated and is programmed on the blockchain, which in other words it can be called decentralised currency. While on the other hand, the NFT is but with the same blockchain technology but it can be in the form of art, music, access tokens, fashion. Utility..etc.

Difference between NFTs and Cryptocurrencies

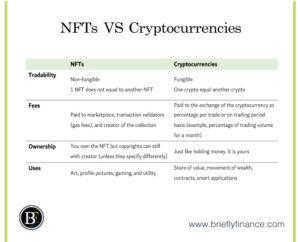

Ability to Trade

NFT is built on the same technology as the cryptocurrencies. The difference is that it is a “non-fungible token” means the value is different from one NFT to another even within the same collections.

For example, two identical NFT photos could be sold with a different price, the main reason of this difference is because each NFT has its own unique metadata (picture properties) and this uniqueness make each with its own value.

A cryptocurrency is like fiat money which is fungible, this means that 1 eth is exactly equals to 1 eth. This is because each currency benefit is the same as the other.

Exchange Fees vs Royalties

When buying NFTs fees are paid to the marketplaces the NFT is listed on, the transaction validator who are the cryptocurrency miners related to the NFT blockchain, and royalty fees for the creator of the collection.

When it comes to cryptocurrencies, there are two ways to calculate the fees which are paid to the exchange you bought the currencies from. It could either be per trade or as a percentage of trade volume in a given period.

Ownership

Whoever is holding an NFT, owns the NFT along with its metadata (its properties like date created and its rarities attributes) while the intellectual property remains to the creator/original artist.

Owning a cryptocurrency is just like holding money. You own it.

Uses

NFTs are used as:

- Collectible art

- Profile pictures

- Gaming assets

- Utility and accessibility

Cryptocurrencies are used as:

- Store of value

- Movement of wealth

- Contracts

- Smart applications

BONUS: Inverse Relation to Market Sentiments

Interestingly in the current markets (2021, it may change in future). The NFTs and cryptocurrencies prices are inversely related.

When price of cryptocurrencies decrease, the sellers tend to move away from the currency and jump in NFT project to maintain their wealth. On the other hand, when cryptocurrencies prices go up, they tend to sell out their NFT to catch up on the gains cryptocurrencies are having.

Final Thoughts

Both NFTs and cryptocurrencies are just digital assets held by investors/collectors for their different purposes. They are both different in nature and both provide benefits.

Before jumping in either of them always make sure you have done your research as it will be better than taking unreasonable actions. Also, the more knowledge you have about them the more you will be able to handle the market fluctuations these assets come with, which is a lot.

Related Posts:

- Cryptocurrency for Dummies – Everything I learned About it

- Are NFTs a Pyramid Scheme? 4 Reasons Why it Feels Like it

- 3 Types of Financial Statements Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.