Because NFTs are built on the blockchain that is backed by a cryptocurrency they are very risky. But some get really expensive and make lots of returns. You may want to get into these large cap project. One way to do that is by buying the NFT coins tokens.

NFT related coin tokens are good way to access expensive NFT project. It provides you with access for yielding and governance benefits and some provide utility to direct NFT holders receive.

Attribution: The icons has been designed using resources from Flaticon.com

Disclaimer: As usual, this is not a financial advice and you have to do your own research

When it comes to investing in NFTs, a well-rounded research will help achieving best probability of success. Here is a link to an article I worked on about NFT investing. Other than that, let us focus in this post on pros and cons of buying NFT coin tokens.

Attribution: The icons has been designed using resources from Flaticon.com

To be specific, investing in NFT coins requires in-depth knowledge about the project you are researching particularly the utility behind it.

With regular NFT projects you can go away by buying a NFT with notable brand and art that makes it valuable.

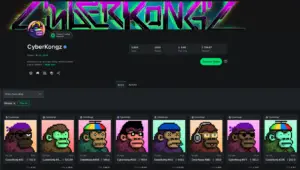

For example, CyberKongz is one of the well known NFT projects with their Genesis Collection floor price of around 100eth. While their NFT price has historically been overall up in value, their associated coin $Banana have been on a downtrend lately.

Because the value of the coin doesn’t just come from the collection and the brand but it also comes from the utilities it provide. Recently CyberKongz released a new game called Play and Kollect that adds more value to their Voxel Collection and the $banana token. Here is link to their website if you are interested to explore more about them.

Source: https://looksrare.org/collections/0x57a204AA1042f6E66DD7730813f4024114d74f37

Anyway the above discussion is just to give you an overall idea of the ecosystem and how NFTs and their coin could have different pricing dynamics.

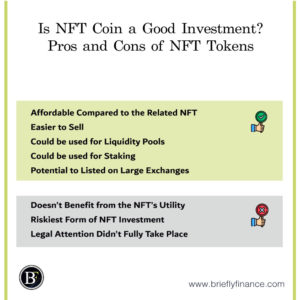

Pros of Buying NFT coin Tokens

Affordable Compared to the Related NFT

The main reason that I think its ideal to get a token related to a NFT is because of the affordability. Some NFT collections tend to jump very high in price, and certain type of investors do not want to jump in early and take that risk but want to hold a NFT that have proven concept.

To get into that usually the tokens are the easiest access and has most affordability in terms of risk and return.

Easier to Sell

Selling your NFT can be hard, first because of its illiquid nature which means if you need the money urgently you will either sell it below floor or have to wait for very long time. Also, because if you only hold one NFT and you plan to sell it, you will be outside the project which is not usually the case that you want to be in.

These situations we encounter in life like illiquidity challenges and attachment to a certain NFT is disturbing. Buying a coin token in the ecosystem will allow you to overcome this issue by having a liquid token and without having to “sell it all” which is great!

With lower entry point you will also be able to create a diversified portfolio instead of keeping it concentrated on few projects.

Could be used for Liquidity Pools

As a decentralised ecosystem, the space will always require users that add their tokens to liquidity pools to assist in the trading process. Such places can return income to the token holders.

Just to clarify, a liquidity pool is where token holders are able to add their crypto for others do quick trades. So for example, let us say John want to buy 5 $Banana with Ethereum. In order to do that he will have to go through an exchange and offer his request. Because of the way the ecosystem works it will be difficult for the transaction to go through unless there is someone else trading at the same time. But with liquidity pool the tokens will always be there in the system. Below is a useful explanation from Finematics YouTube Channel.

By holding tokens in general you will be able to add them to liquidity pools and make money out of the users buying and selling this token.

Could be used for Staking

Another way to make money from your crypto is by staking, which is basically a way holders indicate that they are fundamentally supporting the ecosystem of the token and get rewarded from doing that.

A trick to find out if the NFT project coins have staking is to look for their Whitepaper and check out the “Tokenomics” of the coins section. It should show you how much % are they distributing of the total supply to the holders who stakes, NFT holders, and for rewards and giveaways.

To be fair, there are not many NFT projects that been doing that. Because they mainly emphasise the value of the NFT and allow their holders to stake the NFT itself instead of the tokens. But I had to share it with you guys because it is a source of value for the coins and projects can do it.

Potential to Listed on Large Exchanges

Unlike cryptocurrencies, NFT is still early and buying NFTs can be a challenge for newcomers it will include creating an account on an exchange, deposit your money, make a wallet to buy a NFT and much more.

Having said that, this difficulty adds a barrier to users entering the space even if they want to. But with having a coin token, the project creators can submit this token for multiple exchanges which means it more accessible for wider audience.

Some tokens like $Mana of Decentraland and $Sand of Sandbox are listed on well known exchanges like Binance making the tokens more valuable and early adopters were rewarded really well.

Cons of Buying NFT Tokens

You can’t Benefit from the NFT’s Utility

Buying the coin tokens look attractive and have many benefits, but if you think about it, tokens that have NFT may not fully benefit from all the utilities. This happens because projects usually support the NFT holders most of the time.

Also, if you are huge fan of NFTs Art will miss out owning your own profile picture project that is usable on your social accounts and the metaverse (soon).

Riskiest Form of NFT Investment

Buying NFT is extremely risky. Buying a coin associated with a NFT project is even riskier. You will have to:

- Bet on blockchain network concept;

- Bet on the cryptocurrency (like Ethereum);

- Bet on the NFT project on that specific blockchain;

- Bet on the Coin of the NFT project.

Legal Attention Didn’t Fully Take Place

Notable to mention that the status of this space is new and the Securities and Exchange Commission (SEC) still didn’t fully regulated it.

When there is a token with high monetarily value it means that regulators will definitely start supervising it. It will be through treating these tokens as securities, meaning they will be taxable instruments and also means creators have to oblige with the regulation.

I’m not a legal advisor but I just wanted to share with you this point of view because it is very important to keep it in mind. Here is a link from a legal website about the topic.

Before discussing the alternatives, here is the recent survey I made related to this post.

8 votes from my Twitter followers. (follow me @Marshoush90 so we have more votes in the future!)

Alternatives Options

Buy a Fraction

It is notable to mention that there are alternatives ways to access the NFT project without having to buy their coin tokens. One of them are fractionalised NFTs. These are basically buying into a partial share of a NFT project item. For example, you could buy a partial share of a CyberKongz and own it with multiple users.

Having said that, it is still won’t be as useful as owning a full NFT because you will not be able to fully utilise the utility it provides. Here is a link for a website that sells fractionalised NFTs (Disclaimer: I heard its legit but never used it myself DYOR)

Buy a NFT that support it

Another alternative is to buy a NFT project that is invested in other projects. For example, Head Dao fractionalise the NFTs for their holders allowing exposure beyond that NFT itself.

By doing that you are still have a sense of community from buying that NFT.

Source: https://opensea.io/collection/headdao

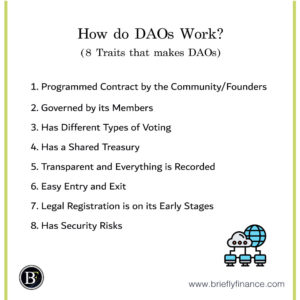

Buy into a DAO

Investing in Decentralised Autonomous Organisation (DAO) is another way to invest in a NFT or group of NFTs you are interested in. By doing this, you have to look for a DAO that has similar investing thesis to yours and be part of it.

An advantage of being in a DAO is you can be diversified. While the disadvantages if you invested little amount of money you have no governance over it and controlling holders can sell or buy NFTs that you may not necessarily want.

Here is the link of the posts that I discussed how DAOs work.

Attribution: The icons has been designed using resources from Flaticon.com

Final Thoughts

This space is exciting and there are continuous innovative products and services that allows accessing NFTs. Having these options is really good specially when there is a project you really care about and can’t afford or when you just want to diversify with limited amount of investing budget.

Related Posts:

- Why are NFTs Expensive? 7 Reasons that Makes NFTs Valuable

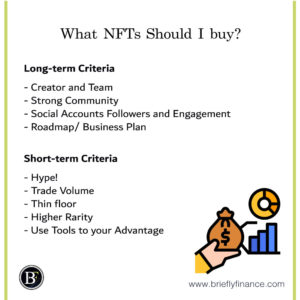

- What NFTs Should I buy? a Comprehensive Guide

- 4 Ways to make Passive Income from NFTs

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.