I am sure you heard about someone sharing his experience about how he bought a NFT for few hundred dollars and then sold for thousands of dollars. This strategy only works by buying in a good project in a proper time then selling it.

For some of us like myself, we do not necessary want to buy and sell NFTs actively all the time specially if we like what we have.

There are ways to make money passively from NFTs by holding, renting, staking, and engaging with them.

In this post we will discuss 4 ways that a NFT holders could make money passively.

Disclaimer: the below are for educational purposes and are not a financial advice. Never spend money you can’t afford to let it go to zero.

Attribution: The icons has been designed using resources from Flaticon.com

1- Generating Tokens

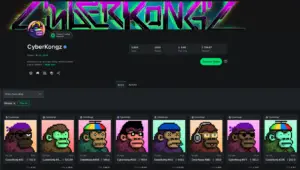

Certain NFTs that you hold could generate tokens, some of them make a lot of money and can be equivalent to a full time income. A well-known project called CyberKongz, As of today (30th January 2022) has a floor of around $330,000. Generating 10 $Banana tokens a day which are valued at $340 a day/$124,100 a year income.

If we assume that the price of the CyberKongz and $Banana token stays the same returns will be equal to %37.6 annual yield distributed daily and an IRR of 45.6%!

Source: https://looksrare.org/collections/0x57a204AA1042f6E66DD7730813f4024114d74f37?filters=%7B%22attributes%22%3A%5B%7B%22traitType%22%3A%22Type%22%2C%22values%22%3A%5B%22Genesis%22%5D%7D%5D%7D

Source: https://www.coingecko.com/en/coins/banana

You may wonder, how can the NFT and tokens maintain their prices? there is nothing backing them up.

These NFT projects are driven by their community and ecosystem they developed. The $Banana tokens have value because using them allows the holders to engage in the community by minting their VX (Voxel version to use on the Metaverse) NFTs and provide additional benefits from the Banana Shop. Here is a link of their website if you are interested in further explore what they do to maintain their $Banana value.

This was an example of one of the most successful case studies of token generating projects. But that does not mean all projects will be doing the same. A lot of them failed and sustaining this business model requires commitment from the team, and the community around the project.

-

Renting

Imagine if Disney’s Partner’s statue NFT, the Walt and Mickey Mouse from the Golden Moments collection has a utility for their holders of 25% discount for activities in Disney World. As a holder of this NFT that would be great! but in reality most of us will not go to Disney World everyday. With such benefit, holders can rent the NFT for other users generating passive income and allowing borrowers enjoys the benefits.

But why would Disney ever do that? First this will make the NFT more valuable and the more trades will take place generating more royalties income for Disney.

A well-known NFT renting platform is reNFT. It allows the lender to choose the days they wants to rent out their NFTs and the borrower to pay for renting it out. You can check this link for more explanation.

Renting NFTs is still uncommon, but once NFTs goes mainstream and highly demanded NFTs with utility are not within the price range of users, renting NFTs should start picking up.

-

Staking

Some NFT projects like Mutant Cats allow you to be part of a Decentralised Autonomous Organisation (DAO) that has fractionalized ownership of certain NFTs (basically it’s like a pool of money invested on behalf of the holders). The owners of these NFTs will be receiving generating $Fish tokens through staking (which is locking down the NFT) allowing every holder accumulate voting rights and accessibility for giveaways and airdrops raffles.

Source: https://mutantworld.com/

Ok just incase you want clarification of these terms.

A Decentralised Autonomous Organisation (DAO) is a decentralised entity ruled by all the holders of the tokens where the decisions are taken based on the votes of the users’ percentage of ownership.

Fractionalized NFTs: are NFTs that can be partially bought. Fractionalized NFTs allow users who do not have enough funds to buy NFT to still be able to be part of a project. Here is a website that provide this service.

4- Play-to-Earn

As gaming have been leading the entertainment industry with revenues of $57 billion industry larger than both the movie and music combined (according to NPD Group 2020).

NFTs were also developed to capture market share of this industry by giving holders ownership of the gaming assets as NFTs and reward the players with tokens/NFTs to encourage a larger user base and engagement.

An example of a play-to-earn game is Axie Infinity which is currently the most popular in the space where players can buy breed and battle to earn tokens/NFTs.

Source: https://axieinfinity.com/

Ok I know this is not necessarily a passive way to make money, but many of us play video games as part of our lifestyle and one day you may find a game you like that could earn you money passively.

Final Thoughts

Owning NFTs allowed buyers to not just use those JPEGS as a profile pictures, but also engage with it, benefit from its utility, fractionalize it, and rent it.

We are in very interesting times. I am very excited to see what other new methods will NFTs be used for generating passive income.

Note: If you are looking for a hardware wallet to securely start your NFT journey (adds extra layer of security for your assets), I would recommend checking out Ledger . Personally, I use Ledger Nano S as it does the job i need and it is affordable.

Related Posts:

- Why are NFTs Expensive? 7 Reasons that Makes NFTs Valuable

- What NFTs Should I buy? a Comprehensive Guide

- Is NFT a Cryptocurrency? NFTs vs. Cryptocurrencies Explained

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.