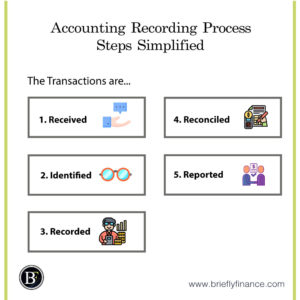

Most people think of accounting as the financial statements (income statement, cash flow, and balance sheet). But in realty a major part of accounting is the bookkeeping process which starts from receiving the invoice/receipt step to the reporting/presentation step.

I know that there is much depth in a whole accounting process, otherwise organisations will not have stacked departments with accountants for many different roles.

But generally, accounting recording process includes receiving the invoice/receipt, analysing/verifying, recording/storing, and reporting/presenting.

Attribution: The icons has been designed using resources from Flaticon.com

In this post we will discuss a typical 5 steps on how accounting transaction is taken from the recording to the presentation step.

Before we start…

What is the purpose of accounting anyway? Businesses do accounting to track their sources of money, how they used it, and the performance of business in terms of income and expenses on “accrual basis” or in other words the business performance on a certain period basis.

-

Receiving transaction related documents

As a bookkeeper in a business, he or she will be receiving a document or an online mean of communication related to cash deposit, or an invoice/receipt from a purchase/sale.

This is the first step in the accounting process. These will be usually given by colleagues from the sales and procurement side of business when it comes to invoices and receipts. And they could also be related to transfers from the owners of the business or from investments.

-

Identifying the transaction

The next step is to verify that these are relevant files. Are they signed? Stamped? Is the email valid?

This of course depends on the company you work in. but identifying information is important before recording the transactions. As going through the recording process aimlessly may create more work load if there was any mistake.

Also there are transactions that are taxed and knowing your jurisdictions tax rules and regulation is going to be important before going recording it.

-

Recording

After identifying the transaction now it is time to record it on the system. The knowledge of the debits and credits in accounting is necessary here. Especially in an organisation that record their transactions manually.

Many variables may impact how you will record the transaction.

Most large corporations have full-fledged accounting software enabling transaction recording without any in-depth accounting knowledge, all you may need to do is:

1- Upload the scanned picture of the document

2- Specify its name and category and choose the right accounts. (The account you can choose is a sub-account name by the company of the main components in the balance sheet and income statement which are Assets, Liabilities, Equity, Income, or Expense)

3- The transaction also gets reviewed by a second person to approve and ensure there is no misclassification or recording error.

On the other hand, small businesses mostly require you to manually update their transactions on an excel sheet in one or multiple tabs, due to the nature of the businesses it may include unusual transactions too.

Let us not forget, after recording the transactions on the computer software, as part of the process is to keep the documents printed/scanned and stored in files properly depending on how the organisation is categorising them.

-

Reconciliation/Closing

Now all the data is gathered in the system. But as we discussed earlier, the nature of accounting is not recorded on cash basis, it is recorded on performance basis (accruals). This means there is one last step to do before being able to share the recorded information which is ensuring the identical compatibility of accounts with the actual cash available in the bank.

That is why at the end of an accounting period (month, quarter, year) accountants double check their figures with bank statements and available cash they have which is called bank reconciliation.

What they basically do is compare the bank statement and cash in hand with the numbers in the accounting system. Ideally there should be no difference. Otherwise they have to go transaction by transaction to find the discrepancy.

If everything is balanced then the information are properly recorded and is ready to be shared with the management/shareholders.

-

Reporting and Presentation

Most software and even excel sheets have an auto generated financial statements which includes income statements, balance sheets, and cashflow statements. If you want to know about these statements you can visit one of our posts on this link.

But in reality there is much more when presenting the financial information, there are several custom records that may be requested, below are some examples:

– Management may require certain information to be shared which can be as a point of discussion for their next business strategy

– Finance team may want certain financials to do their budgeting targets.

– Investors and creditors like banks would require description the financial information which includes notes on line items describing further information and also the calculation methods.

Let us not forget, the accounting rules and principles that are required by GAAP in the US and IFRS also require a formal way of reporting which are industry standard allowing any possible investor or a financial institution to understand the presented data properly and are able to compare it with other peer organisations.

Final Thoughts

Basically the above was a simplified steps in recording process in accounting.

There is more depth and it depends from a situation to another. But my goal in this post is to make sure that you as a reader have a feel of what an accounting records process is like and whether you find it interesting.

These steps can be a repetitive jobs by accountant specially with the utilisation of the software available where there is a maker and a checker streamlining the processes while reducing the possibility of mistakes. However, it is an occupation that many firms need and it has very high potential for any employee career progression as money literacy is an important requirement for any organisation.

Related Posts:

- 4 Tips to Become an Accountant Without a Degree

- What are the Objectives of Accounting?

- Is Accounting a Good Career | Everything you Need to Know

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.