Managing your finances is important. At some point, you may have wondered if you need a personal accountant. Well, you’re not legally required to have a personal accountant. However, having one makes it easier to track your money and ensure that you’re making sound financial decisions.

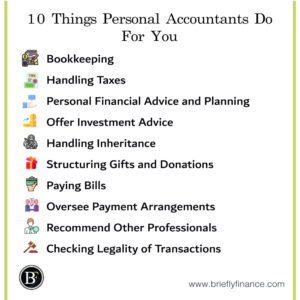

In general, a personal accountant will do your bookkeeping, help you pay bills, prepare your tax returns, and check whether your bank and credit card statements are accurate.

These are things that can be very costly if you fail to do. Take your credit and bank statements, for example. They may have wrong values. And if you don’t detect those errors quickly, they can ultimately affect your credit score and deter you from accessing credit facilities like loans and mortgages.

The problem is, most people don’t really have the time to thoroughly analyse their statements. And those who do don’t necessarily know how to check for errors. That is where personal accountants come in.

Attribution: The icons has been designed using resources from Flaticon.com

Let us discuss the roles of a personal accountant.

-

Bookkeeping

A personal accountant will keep a record of your transactions, particularly those relating to personal finances. They include utility bills, personal loans, credit cards, mortgage payments, travel expenses and pretty much any other personal transaction.

Some of these expenses are tax deductible. A good example is medical payments. You’ll, therefore, need the receipt as well as the bookkeeping process to show that you’re entitled to the tax deduction.

Keep in mind that your personal bookkeeper won’t follow you around to record every single transaction you make (of course, unless you ask them to). Instead, they’ll simply use your receipts, credit cards and bank statements for bookkeeping.

Most of them will try to make the work easier by introducing you to financial software like QuickBooks. Such programs make it easier for you to record and track your own transactions. The accountant will only come in when there’s a need for further analysis and preparation of statements.

-

Handling Taxes

Filling tax forms and filing tax returns is never fun. The good thing is that you can avoid it all and let a personal accountant do it for you. They’ll prepare all your returns and advise you on the best time to file in order to avoid penalties.

If you’ve always done your own taxes, you’re probably feeling reluctant to pass the job to someone else. That’s understandable if you’re dealing with a fairly small income.

However, as it grows, your taxes become a little more complex. The same applies for self-employed people and those with multiple streams of income. A personal accountant will ensure that: first, your returns are filed in a timely manner, and second, you don’t pay a penny more than you should.

In fact, a personal accountant will ensure that you take maximum advantage of all the deductibles that you qualify for. For example, did you know that if you are a homeowner, then you can enjoy tax deductions on your mortgage interest as well as property taxes?

You, however, need to itemise all your deductions to qualify. Personal accountants know this and they’ll help you itemise every expense so that you get the highest possible amount of deductions.

-

Personal Financial Advice and Planning

Have you ever gone out to buy a dress and came back with shoes too? Or decided to go out on a “budget trip” and came back with an empty wallet/purse?

It happens to everyone; at times more often than you might want. Whether you’re a big spender or impulsive buyer, a personal accountant can help you get out of that habit and better plan your finances.

First of all, they will explain to you why impulse buying and spending big bucks affects other parts of your personal finance. Let us say that you go out and unintentionally splash $3,000. Your personal accountant will have to explain why you can’t take a trip the following month. Why? Because the $3,000 has to be returned somehow.

In some cases, impulse buying can affect your ability to pay the most important bills like mortgage loans and utility bills. Under such circumstances, a good personal accountant will create a daily, weekly and monthly budget for you. This will put a spending limit to any indulgence and prioritise your most important bills.

Periodically, the accountant will prepare reports that explain all your expenses while outlining financial advice. If, for instance, you’re in debt, they can suggest ways of saving up some amount each month until you pay the debt in full.

-

Offer Investment Advice

Speaking of saving, a personal accountant can also help you save enough money until you start a small business. As mentioned already, they not only look for tax deductions, but they can also help you not to spend on unnecessary things. And when your pool of cash is large enough, you can (again) turn to your personal accountant to help you invest it.

For one, they will do most of the financial groundwork. That includes filling all the necessary tax forms, helping with a business plan, evaluating loan offers, offering tax advice and so much more.

As the business grows, a personal accountant will minimize your tax bill. For example, they can advise you to channel more money towards a corporate life insurance policy (rather than taking it home as dividends) because it is tax free.

Keep in mind that the average tax rate for personal income in the U.S. is 24% based on OECD taxing wages report 2020. If in a year you earn $300,000 from the business, you’ll be subject to at least $72,000 in taxes (will be a lot higher because you’ll be on a higher tax bracket than the average of 24%).

Therefore, your dividends will be $228,000 at most. But if you put that money into a life insurance policy, you get the entire sum ($300,000 plus interest). You can use it to grow the business even further. Long story short, a personal accountant will help you make good business decisions.

-

Handling Inheritance

Receiving an inheritance – especially if it’s a large one – can attract exorbitant inheritance taxes. Besides, you may be slapped with a very high tax rate on your income and property. If you have a personal accountant, they’ll advice you on what to do so that you only pay what you should.

-

Structuring Gifts and Donations

As is the case with inheritance, some gifts and donations attract taxes. The IRS requires that any gift exceeding $15,000 (or $155,000 per year) should be taxed. However, you can qualify for a tax exclusion under certain circumstances.

For example, you may avoid tax altogether if the gift is a property and the recipient intends to use it immediately. These are provisions that a personal accountant can look for so that you don’t pay taxes when you can avoid them.

Another option is using a retirement fund to make a charitable donation. It not only reduces the amount of gift tax, but it also increases the value of the charity.

-

Paying Bills

Fun fact: only 21% of Americans pay their bills on time based on Bureau of Consumer Financial Protection (November 2018). It’s not always a question of lack of money. There are people who just forget to pay their bills until it’s too late. Others are too busy to do so, particularly those who have to make physical payments for one reason or another.

The problem is, defaulting a bill (knowingly or unknowingly) can hurt your credit score. That’s something you won’t have to worry about if you have a personal accountant. They will either remind you to make the payment or they will do it on your behalf if they have access to your accounts.

-

Oversee Payment Arrangements

More often than not, a personal accountant will operate behind the scenes. For example, they won’t meet your landlord/lady to present a monthly check for your rent.

However, in some cases a personal accountant will take an active role and negotiate payment arrangements on your behalf. They can negotiate will sellers to get you a lower price.

Similarly, your accountant can talk to creditors, the IRS, credit card companies and even banks, and negotiate for a payment arrangement on your behalf. After all, the accountant knows how your finances look and will be objective when negotiating.

-

Recommend Other Professionals

If you face a challenge that’s not necessarily within their scope, a personal accountant can look for a qualified professional to help. Most of them have close connections with people in similar industries. Thus, if you need an insurer, banker, lawyer, money manager, investor etc., the first person to talk to should be your personal accountant. They will find the right person for the problem.

-

Checking Legality of Transactions

Last but arguably most importantly, a personal accountant reviews financial records for accuracy and compliance with the law. If you wrongly fill a form – say a tax form – the best case scenario is that you file an amend return with the IRS.

Worst case scenario? You will be prosecuted for tax evasion. That can happen if the IRS conducts a tax audit and discovers that you left out material information. Section 7201 of the IRS makes tax evasion a felony that can get you fined, imprisoned or both.

Luckily, personal accountants usually review transactions as well as documents to ensure that you are fully compliant. Therefore, that should be a huge burden off your shoulders.

You Can Be Your Own Accountant

So, what is a personal accountant? The simple answer is that a personal accountant is someone who can handle all your personal finance needs. But can you do it yourself successfully?

Of course you can be your own accountant. Recording your income and expenses is not a difficult task. You don’t need any accounting knowledge to do it successfully. In fact, with accounting software like QuickBooks on Amazon which is good for small businesses and Wave Accounting which is good for individuals and freelancers, you will get a full picture of your income, expenses and what you can do to improve your financial standing.

Taking the DIY route is a great option if you cannot afford to have a personal accountant. It will, however, require more time and effort. And you’ll also have to deal with the tedious process of filing your own tax returns. At the very least, consult a certified public accountant (CPA) and ask them how you can itemise your deductibles so that you get a bigger tax break.

Personal Accountant vs. Financial Advisor: What’s The Difference?

It’s worth mentioning that a personal accountant is not the same as a financial advisor, most people often confuse accountants with financial advisors. Also known as financial planners, financial advisors focus on three things: budgeting, managing debt and investing.

While an accountant can help with handling bills, filing tax returns, bookkeeping and so on, a financial advisor will strictly help you plan for your money. Therefore, if you want to save for a something (college, house, car etc.), plan for retirement, do insurance planning, create a budget, get out of debt, invest your money or plan your estate, you may want to talk to a financial planner.

If you want to know more about financial advisors the balance has an interesting article about the topic.

Final Thoughts

Many people tend to avoid the idea of having a personal accountant or financial advisor. I understand that because most of service providers charge much money that it is not even worth it to benefit from their service.

When it comes to a personal accountant it could be the same. Just remember, you could benefit from their service for few months and get educated on how they help you manage your finances before letting them go, its subjective in the end.

I hope you enjoyed the post. Do not forget to share it with someone that could be thinking of having his own personal accountant.

Related Posts:

- 6 Reasons Why Accounting is the Language of Business

- 3 Money Mindset Books to Grow and Maintain Your Wealth

- Is Accounting a Good Career | Everything you Need to Know

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.