DeFi has disrupted the way financial industry work. it created new ways of financial products and services that helps customers work in a trustless, and fast paced environment.

DeFi projects teams makes money through holding significant number of their initially launched tokens and through the benefits from transaction fees and yield farming the service established.

Before starting off the topic, you may want to know what sort of services DeFi provide:

Attribution: The icons has been designed using resources from Flaticon.com

Check out this post for more details.

We will use Uniswap as an example case study throughout this post which is a well-known decentralised exchange in DeFi. Feel free to read the introduction to their token here.

Creators Raise Capital through ICO

In general, when a project is created it primarily operate on a smart contract uploaded to the blockchain, which is basically the script that makes this whole service works without having an employee doing the transactions manually.

Some of these program founders teams raise money instead of holding 100% ownership of that service. it could be through an Initial Coin Offering (ICO) which is like raising equity in stocks which gives % of governance based on tokens held or agreed in the whitepaper.

Project creators will usually have a large portion of the percentage ownership in the project. While the remainder goes to investors.

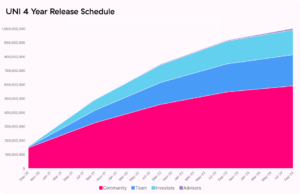

So for example, Uniswap decided to raise capital through issuing a token (UNI). This token is shared to the community members along with the team, advisors and investors.

Source: Uniswap

As you can see in the example above. Uniswap team provided the community instant 15% amount of UNI for community members while vested the distribution for the team and investors over next 4 years.

Team, investors and advisors are going to get compensated on later stage showing sign of confidence in their project over the long term.

But it does not feel profitable for project creators?

It may feel strange that there is no sustainable income for the team members over the long term right?

Let us just keep in mind that this service can work by itself, ideally team members can join and leave whenever they want, and they have significant percentage of ownership in the token.

It means they can vote on how revenue is distributed, for who, and what are the future plan. So, if you think about it, in general the whole team want the project to succeed, so a good team, investors and community with long term mentality will make the project profitable.

Let us elaborate more about the recurring returns in the next section.

Creators Hold their Tokens and Generate Returns

Ok, now the project creators have significant amount of tokens, where is the value comes from?

It is generated through services’ transaction fees and yield farming (staking and liquidity pools).

In the case of Uniswap here are 3 ways holders can generate returns:

- Transaction fees: transaction fee is generated from the liquidity pool mechanic. To simplify it, it is a way where users are able to participate in making tokens exchange easier by providing liquidity in the system. And by doing that they will be able to generate transaction fee returns from arbitrage which are distributed in form of UNI token.

Those fees Uniswap have from exchanges could vary from 0.05% to 1% depending on the proportion of members in the liquidity pool and also it depends on the prices of the two exchanged currencies. Here is a link from their website for more details about it.

- Staking: there will also be 2% inflation of the token yielding for users who stake their tokens. Which means basically depositing their tokens in the platform which is an indication of showing their support and in return get more tokens as reward.

These 2% token rewards proportion of how much tokens are available in the pool. This method has been used to protect holders against inflation over the long term.

- Governance: Token holders can propose what do they want to do with the project. The holders here plays the role of management and allow the project to better operate over the long term.

Through proposals and holders voting they could decide what is the project next step, whether it is about building new features, distributing revenue from project treasury, or doing partnerships…etc

Just a disclaimer, this was an example of how Uniswap work, I just hope you treat it as a case study only and not a financial advice. I am not sure if I covered everything they provide nor know if there has been any update with the project.

Final Thoughts

With the ongoing adoption of the decentralised services it is possible that it will generate decent income for the creators and also the holders.

Competition could be extremely tough because now there is no trust required between the buyer and seller unlike the traditional banking system that means that whoever is providing cheaper services users will most likely get the customers.

Related Posts:

- Cryptocurrency for Dummies – Everything I learned About it

- What is a Smart Contract? and How Does it Work?

- What are DeFi Products and Services With Examples?

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.