Decentralised Finance (DeFi) is a growing service that one day could disrupt the traditional banking. It generally operates with less fees and higher trust between related parties. It offers a wide range of services that removes the need to use financial institutions.

DeFi products and services provides products and services similar to traditional banking which includes lending, saving, insurance, investing and others. What is unique about it is that it is decentralised and does not require trust and has less fees most of the time.

Attribution: The icons has been designed using resources from Flaticon.com

In the centralised monetary ecosystem, money is held by the financial institution and technically central bank can do anything they want with your money. Whether it is directly, if a bank shuts down and lose some/all your money for example (if insurance doesn’t cover it), or indirectly by printing money and reducing your money purchasing power.

Also the traditional financial transactions takes time when its transferring money or issuing customers loans.

Just a disclaimer before we start.

Decentralised platforms are not regulated and can always change or get hacked. always do your own research before using any platform I provide as examples below.

OK! let us discuss list of products and services that are provided in the DeFi ecosystem.

Stable Currencies

Stable currencies or as they call them stablecoins are one of the main pillars in the DeFi ecosystem.

What happens is when users are holding cryptocurrencies they are exposed to the volatility risk of these currencies and in order to get back to the US Dollar, they have to deposit their money back to their bank account which in return will take time and it incur transaction fees.

a stablecoin is a cryptocurrency pegged to the dollar allowing its holders to not have to take the money out of their wallet.

For example, Dai is a cryptocurrency that is connected to the US Dollar.

Saving Accounts

You may wonder how do a Cryptocurrency is connected to the US dollar and still stay stable? well, it has “savings accounts” in this ecosystem incentivising users to not trade it.

Unlike lending your money for gaining interest, you will deposit it in a stablecoin account that provide you interest where their goal is to make sure that this currency does not fluctuate and want most of it to not be traded as much.

Again, Dai stablecoin which is regulated by MakerDAO serves that. Here is the page where they show the way you can earn from their platform and explain the technical aspects of it.

Lending and Borrowing

When you go to borrow money from a traditional bank you will have to go through due diligence and you will be required to pay lots of fees and interest to the bank.

Decentralised lending will allow you to take loans with less fees and also not have to disclose what you want to buy. Having said that, this means there is trust and also privacy when taking a DeFi loan.

But here’s the catch who would give someone money without having a backup plan to secure their returns? this works by giving the borrower a high collateral requirements of another cryptocurrency in case the borrower does not pay it can be easily withdrawn by the smart contract.

So unlike traditional banks where your credit score, job position and salary slip determining the amount of loan that you can take on the cryptocurrency space it is about the value of the collateral you have and ensuring it does not fall below a certain ratio otherwise the contract will be stopped and your cryptos will be taken away.

Cryptocurrency as Collateral

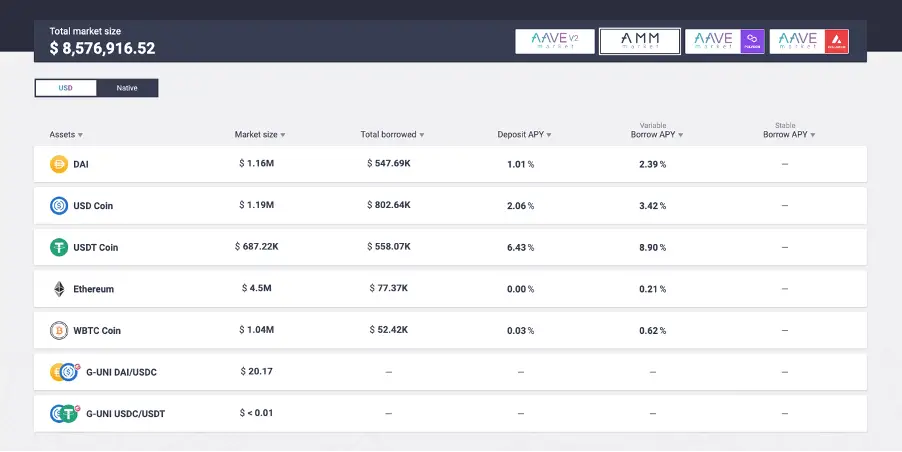

The process can be done through cryptocurrencies or even NFTs. For example, you can use AAVE is one of the well-known platforms for borrowing and lending cryptocurrencies.

Source: https://app.aave.com/#/markets

As you can see above, the platform will show you how much is the rate to borrow and how much is the rate you are expecting to get if you lend. If you want to know how much loan you can borrow it has to be through connecting your wallet and depositing your collateral.

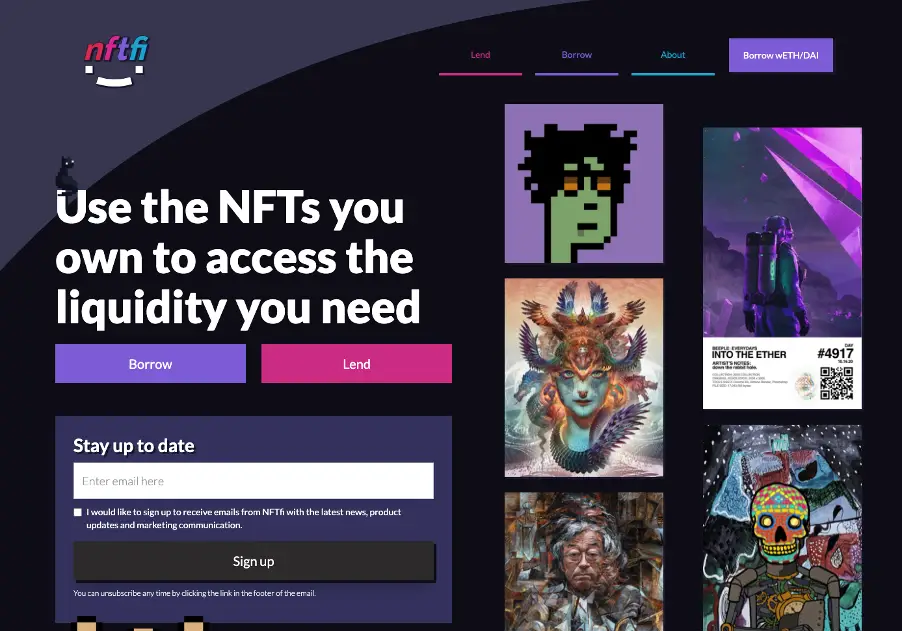

NFTs as Collateral

Other way to get loan is through collateralising your non-fungible Token (NFT) which is a form of digital assets verified by the blockchain.

A DeFi platform that can lend you is NFTFi.

Source: https://www.nftfi.com/

Notable to mention one of the unique services that the default offer is flash loans and what this does is allows users to take a loan and instantly sell the loan to another exchange. By doing that, there is very small marginal arbitrage the borrower can make from this transaction. This can also be done with AAVE

Asset Transfers

With the benefit of having the blockchain network sending assets through it is very secure, fast and low costs (in most cases) which attract users to use it.

These product will basically require the user to choose the destination address with the amount and just send it, Regardless of how much is the money, there are no limit to how much you can transfer and the fees are relatively low.

These transactions can be done through non-custodial wallets like Binance or through regular ones like Metamask.

And for employers for example, they can use smart contracts that allow automatic salary distribution to their employees. Check it out in this link. It is an example of a (EIPs) contract that can do that. Just note that the contract I shared is still not recommended to be used unless you are a programmer and sure it is properly coded (On Ethereum once a smart contract becomes ERC then it is safer to use).

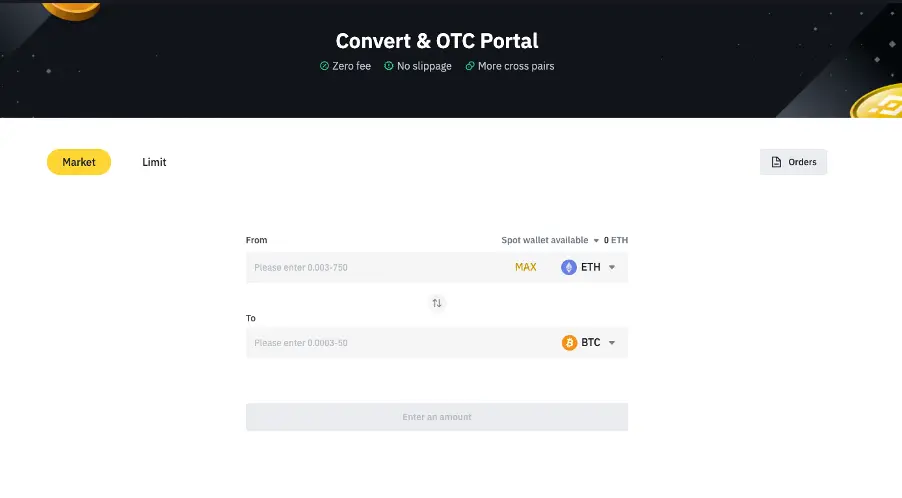

Asset Exchange/Swap

Exchanging currencies is also one of the products that DeFi provides. What is good about it is the lower fees and the speed of transactions.

There are several exchanges that you can do your exchange transaction one is through Binance and another is through a decentralised exchange like Uniswap.

On Binance, given that it’s a centralised company it doesn’t accept all the currencies in the ecosystem but its advantage is that it provides some sort of security if you do not want to hold your private keys by yourself (password of your crypto wallet)

Source: Binance

By the way, I personally use Binance and am very happy with it. If you are interested in getting yours please use my referral link which will provide both of us commission benefits (10% off in spot trading).

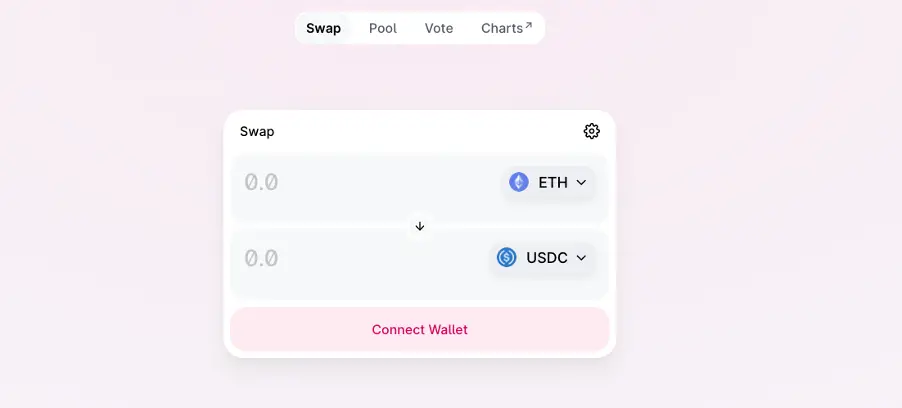

Anyway on the other hand, a well-known decentralised exchange (DEX) is Uniswap. It provides a huge library of tokens that you can choose from and is convenient to use and quick (you do not need to open an account just connect your wallet).

Source: https://app.uniswap.org/#/swap?chain=mainnet

Liquidity Mining

Unlike currency exchanges who keep money with the reception, the decentralised exchanges do not have a liquidity of money to facilitate transactions. A workaround is to create a liquidity pool.

This liquidity pool incentivise users to keep the money in the exchange and provide them with returns through the arbitrage of others swapping their tokens.

So basically when you want to do your liquidity pool mining, you will have to choose two currencies let’s say for example Ether and Dai and then you keep them together in the system which then incentivising you with profits of the transactions others do.

This service can also be done with Uniswap which showed above. Most of these decentralised platforms have multiple services!

Insurance

Just like traditional finance there is insurance services in the DeFi industry.

The way it works is by making a smart contract between the buyer of the policy and the seller and if the smart contract identifies possible breach of the policy requirements it will incentivise the buyer.

The way it works is smart contract is connected to a technology which referred to as an Oracle. So for example, let us see that insurance policy is there against a natural event like a storm, the smart contact will be automatically connected to a weather data mining tool that would alert that the contract if it found danger affecting the policyholder (living in that area) thus this buyer will be eligible to claim their settlement.

An example of the decentralised insurance is through InsurAce. They cover insurance smart contracts protocols and stable coins. Here is a link to their website for more details.

Raise Funds

Smart contracts allow user wallets to access it and receive tokens as an ownership which makes it easy programmed way to fund raising.

Given how the DeFi is structured, there are many ways that capital can be raised. Let us focus on two common ones which are ICOs, and NFTs.

Initial Coin Offerings (ICOs)

ICOs are similar to when private companies goes public or when startups raise capital. Founders provide a white paper which includes business overview and how much they want to raise (in tokens) and what percentage of ownership they are giving.

Investors visits the website with the ICO proposal, they register to participate with a specified cryptocurrency usually it will be either Bitcoin or Ether, and in return they receive ownership from the ICO in the form of tokens.

Non-Fungible Tokens (NFTs)

Another way to raise funds is through selling NFTs. If ICOs were sold as shares a company. NFTs are sold as a collectible item and part of the community or a fundraise for a cause/charity.

NFTs are basically the tokens with unique IDs that has media files associated with them which identify the user ownership of it.

Staking

Staking is a way for cryptocurrency holder to stake their tokens in the ecosystem to show proof of their ownership and participation in the network.

Unlike centralised networks where there is an entity that process transactions like SWIFT. In the decentralised networks they are multiple computers across the world all verifying transactions. To verify ownership percentage of the network is through staking your tokens in the network which in return generate transaction fees for stakers.

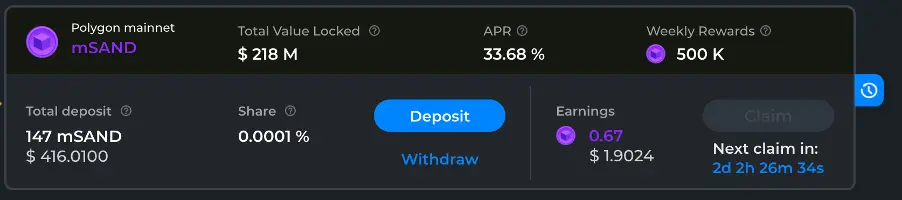

Source: https://www.sandbox.game/

Here is an example from the Sandbox staking. You will see that the staking pool has a fixed reward 500k $mSand weekly (predetermined by the network distribution plan) it distributes to the stakers based on their percentage staked of the total pooled value of $218m.

Derivatives

Derivatives are also available as part of the DeFi services. a derivative is a contract derived from a certain asset like stock price, commodity, or interest rate…etc. To simplify it, it is a contract betting whether the asset will rise or fall in price against the other party in the contract.

The benefit of a DeFi software is transparency, security, and accessibility to wider range of securities including crypto because It is basically a smart contract that can be connected to any trading instruments.

An example of that is Synthetix which is a platform that allows users to interact with derivatives. Personally, I never did this before so please do your own research on that.

8 votes from my Twitter followers. (follow me @Marshoush90 so we have more votes in the future!)

Final thoughts

This space has just started and the type of products and services are imitating traditional banks but that does not mean that they will be the only services. We will probably see many creative products and services that has never been done before.

Related Posts:

- Cryptocurrency for Dummies – Everything I learned About it

- What is a Smart Contract? and How Does it Work?

- How Exactly NFTs are Stored?

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.