While the NFT space has been growing at a fast pace with sales growing from US$ 82.5 million in 2020 to US$ 17.7 billion in 2021. Does this mean there is potential that NFTs will replace stocks?

NFTs and stocks work differently, NFTs can be viewed as a collectible and a utility token while stocks are viewed as ownership in a company. For the time being NFTs can’t replace stocks yet.

Whether we like it or not, many are treating NFTs as investments given the buyers strong belief in the art and mission (roadmap) of the project. This is happening at large scale that could make you wonder, will NFT replace stocks? And what differentiate it?

-

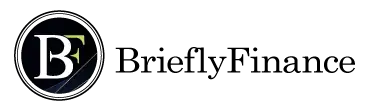

Purpose

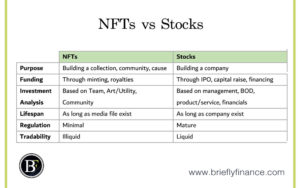

The goal of holding a NFT is mainly for Art collection purpose and utility. When it comes to art people would go for something artistic like the collection shown below from Art Blocks.

Source: https://opensea.io/collection/art-blocks

Art Block is a new way of delivering arts for their users through programmable on demand generative art. if you want to know more about them check out this link on their website.

And when it comes to utility users will go to the benefit that NFT can create through the Web3 technology the utility aspect derives from the programmed smart contracts that connects to the web3 technology. Another aspect of the NFT space that users trust the creators promise of the value they will be giving. But keep in mind, it is not legally constrained.

Here is an example of a utility collection.

Source: https://opensea.io/collection/impact-theory-founders-key

Impact Theory Founder’s Key provide their holders with access to their entertainment studio Impact Theory through holding a legendary key that gives partnership rights. So with this example, you may notice that holding NFT may not give direct ownership of the company but could give some rights and accessibility for the holders.

When it comes to stocks its main purpose of holding is the ownership of the company, by holding a stock you are the owner of the company and the more someone holds of it the greater authority they have.

They can elect who is the board of director, who is the chairman, and yes by doing that they can literally do anything they want to the company.

Stocks holders in the company will also have the right to vote whether they want to distribute dividends and its ratio (part of the Net Income distributed to holders).

So as you can see the difference is a NFT creator could still work on the project even if he doesn’t hold any NFT and still can do whatever he wants with the project. But a stock investor if have enough shares can do anything he wants with the company even be the CEO.

-

Funding

NFT projects generally raise money in two different methods, one way is through minting their project (basically initial sale of the art) the other way is through royalties (% profit from the trading in secondary market).

Such NFT structure is generally good for artists/musicians who want to raise income to follow their path and build a community around it without having to go through a publisher.

On the other hand, stocks raise money through IPOs and capital raise. They could be private companies who decide to sell % of the company shares they own or a public company who want to sale a % share of the company.

-

Analysis

OK, I know investment analysis may not be as simple as that, but fundamentally when investing there is difference analysing NFTs and analysing stocks.

When looking at NFTs, some criteria will include the team, art, utility, collection size, community engagement and size, influencers in the project, and the long term strategy.

Stocks on the other hand, will be based on management and board of directors, product/service core competencies, financial position, financial performance, research and development, regulation around the product/service.

As you see there are similarities but the difference is the way both structured in dealing with the financials is different. So far NFTs main source of income is through the royalties of sales (could be changed in the future) but when it comes to stocks they have their product or service as the stream of income.

-

Lifespan

Everything has a life span period. Eventually every business will fall because the bigger the business is the harder it is to innovate and manage the huge number of employees and maintain the product/service.

When it comes to NFTs it has different potential, the reason behind that is that because it is a piece of art users may want to keep as a collection. And unlike stocks, collections tend to increase in value over time. Holder want to keep it as a historic piece of art/collectible.

One risky aspect of the NFT is if the media file associated with it are sometimes externally linked and could be removed/changed by the original creator. If you want to know how NFTs are stored have a look at this post about storing NFTs.

-

Regulation

Being in a decentralised space, NFT is still on its early stages of regulation and is also more difficult to be supervised yet. That makes the full responsibility of handling any risks is in the hands of the holders who did proper due diligence on the smart contracts and trust creators of the projects.

But when it comes to the stock market there are multiple parties that can protect the investor including the broker (through giving settlements timeframes), insurance (protect part of the money if something uncontrollable occur), and the SEC (the authority that demand proper information disclouser from companies and ensure investors protection).

-

Tradability

There are few reasons why NFTs tend to be illiquid compared to stocks.

Market Capitalisation

Market Cap is just another way to say the total price of buying the full company/collection. And the larger it is means that it will usually have more holders. Having said that, the NFT collections are generally smaller than the stocks which means there are less people who are trading them.

Number of shares

Unlike stocks, most NFT collections tend to be around the 10k items while stocks have way much more. For example, Apple Inc. has around 16 billion shares. These number of shares allows the holders to sell fraction of what they hold when they need, but when it comes to NFT the holders will have to sell the whole NFT they hold (there are fractionalised NFTs but holders may not get all the value they want of it)

Transaction Fees

Given that most NFTs are on the Ethereum network, this network so far have been costing lots of fees to the buyers.

A person that would buy a NFT may have to pay around $30-100 which in some cases more expensive than the NFT itself. That by itself discourage high volume trades.

With such traits, it is hard to conclude that the market is efficient in the NFT space, there is much volatility and having said that it means there is higher risk but also higher returns.

Final Thoughts

Given that NFT technology is still early, and corporations take time to adjust, I don’t think it will replace the stocks yet. However, there is surely possibility for disruption in the field with the blockchain technology that could change the way it works.

Related Posts:

- Is NFT a Bubble? Bullish and Bearish Point of Views

- Are NFTs a Pyramid Scheme? 4 Reasons Why it Feels Like it

- Can I make Anything into a NFT?

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.