With no underlying assets around them, plugged in a decentralised technology, many believe that the cryptocurrencies could just crash to zero. I think some will and some will not. Let us discuss in this post.

Not all cryptocurrencies will go to zero, but most of them will. Few that will succeed are going to be making their holders wealthy. Blockchain technology will most likely stay and support cryptocurrencies.

I know everything has possibility to go to zero and cryptocurrency is the same. If god forbid a nuclear war destroyed the whole internet structure we will not have the blockchain technology to process these coins and we would not care about it anymore.

But you know, even if the whole network was down there are technical ways where the network could restart again. Given blockchain technology saves network files every computer in the world and one of these computers could have all the files and could be reprogrammed again. This term is called a fork you can have a look at it in Coinbase

Attribution: The icons has been designed using resources from Flaticon.com

As much conviction I have in this technology, I am not sure which cryptocurrencies will be the winners in the long-term. Please do not spend any money you are not willing to lose.

Let us discuss the two point of views (not necessarily mine) about this topic.

Views Suggesting Cryptocurrencies Going to Zero

Not backed by Actual Assets

Many believe that cryptocurrency is not backed by actual assets like stocks or real estate.

And having said that, it makes it unreasonable to buy “nothing” at high valuation and in hopes that price will increase.

They believe that the price just comes from the limited supply of the tokens which does not make sense.

Also cryptocurrencies do not generate direct income to their holders which is another component in assets valuation. Maybe it does through yield farming but it just distribute additional of the same cryptocurrency to their holders.

Liquidity Challenges Coming Soon

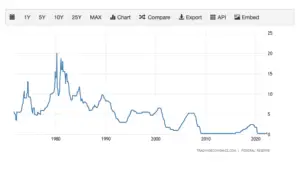

Cryptocurrency have matured through one of the longest bull after 2009 financial crisis. Investors were able to make money easily in such environment.

Source: Google Finance

Economy was growing and financial engineering was maintaining the high performance. For example, interest rates are low which encourage investors to use their money than keep it in the bank for low profits.

Source: Trading Economics referencing Federal Reserve

Some believe that once the economy face real challenges and liquidity dries, money will gradually go out starting with the cryptocurrency space.

Possibility of Hacks

The blockchain technology (which cryptocurrency reside on) is very powerful and have created a very large hurdle for hackers to attack it.

Just to give elaborate, the blockchain network is a group of computers around the world that process transactions which means if a hacker wants to hack the network he has to hack 51% of all the computers in order to execute a transaction.

But with the technology is getting smarter, hackers are also getting smarter and there is always possibility of a major hack. Particularly in this field where its decentralised and there is no centralised authority to protect the cryptocurrency holders or refund them yet.

For example, in June 2016 a hacker managed to hack an Ethereum first Decentralised Autonomous Organisation (DAO) stealing a worth of $55 million of it. For more details check out the story on Coindesk.

Most will go to Zero

Just like the dot com bubble, whether we like it or not the fundamentals of investments is really important, people would leave an investment if there is no fundamentals specially at time of crisis.

Some believe that most of the cryptocurrencies project will die just like what happened in the 1990s and with that the fear could have domino effect even to large cap cryptos.

As referenced in Investopedia discussing the dot com bubble:

On March 10, 2000, the NASDAQ Composite stock market index peaked at 5,048 and By October 2002, stocks had declined in value by 75%.

Only few companies were successful like Amazon and Ebay. If you want to know more about it check out this link.

Why Cryptocurrencies are Most Likely to Stay

Proven Concepts

With presence of over a decade and a proven concept. Cryptocurrency is here to stay. Let us take Bitcoin for example, it grew from around US$1.5 billion in 2013 market cap to US$777 billion today (Statista), where gold was around US$7 trillion in 2013 and is today is at US$12 trillion. This shows how Bitcoin caught up really fast.

You may think why I bring up gold? because Bitcoin is an assets that is always compared to Bitcoin due to its features that makes it a good way to store, transfer, and have maintained value. Here is a great research by Fiedlity Digital Assets describing the differences between them.

it is very hard today to see holders to just get rid of it. This technology is now maturing in its development and is not a one year old project.

Scarcity

With economies printing money as the norm users lose value of what they have. Going to a deflationary cryptocurrency could be the solution…

Holding a cryptocurrency like Bitcoin with a clear total supply capping at 21 million and final bitcoin will be mined around 2140 is a better to hold for sustainable value combating inflation in the market.

Transferability

As a decentralised technology and easy to transfer wealth, users eventually will move to it, specially ones who transact globally. Why wait 2 days to transfer money when you can do it on the spot?

Disruptive Blockchain Technology

The blockchain technology, a platform that allow building a whole ecosystem on is very powerful.

With smart contracts being connected to the blockchain. it enables programming anything you want, its not just about transferring currencies or holding value.

Attribution: The icons has been designed using resources from Flaticon.com

Imagine if holding a cryptocurrency allows you to buy a house through transferring crypto to the user and ensure that he receive the money and then the house door automatically opens to you with all its facilities.

Please follow me @Marshoush90 so we have more votes in the future!

Final Thoughts

If you have followed this blog, by now you know I am an advocate of this technology, I believe in the convenience it gives the holder and with everything is programmed now there has to be a technological connected currency.

However, there is always risk involved. I don’t accurately know which cryptocurrency will succeed. Having said that, always do your own research before buying into anything and make sure to never spend money you are not ready to lose.

Related Posts:

- Cryptocurrency for Dummies – Everything I learned About it

- How do DAOs Work? and What are They Used for?

- What is a Smart Contract? and How Does it Work?

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.