Today, fraud is an ever-present problem that people and businesses are dealing with on a day to day basis, sometimes without even realising it. Since the development of the internet, fraud has become increasingly easier to do and, therefore, more and more common.

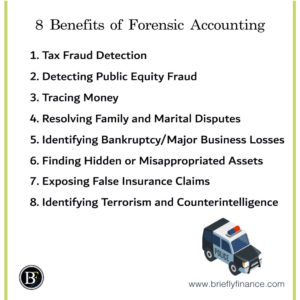

There are laws and policies designed to stop fraud from happening, but the reality is that more needs to be done if people actually want to have any hope of getting ahead of it. One option to successfully avoid the damaging effects of fraud is utilising forensic accounting, which will help you identify how much money you are missing and how you can go about recovering it. It is also often used as evidence in a fraud trial.

Attribution: The icons has been designed using resources from Flaticon.com

-

Tax Fraud Detection

Tax fraud is when an individual or a business makes false claims about their finances, which results in them paying less or no taxes. There is a wide range of things that a person or business might do that qualifies as tax fraud, such as claim false deductions, claim that their personal expenses are business expenses, use a false Social Security number, or not accurately report their income. Any of those things or anything else that qualifies as tax fraud is considered to be a felony.

Forensic accountants have the ability to trace the earnings of certain individuals and businesses to figure out if a person is making false claims and, if they are, what the extend of the tax fraud is. On the other hand, companies and individuals may hire their own forensic accountant when they are accused of tax fraud in order to prove that they are, in fact, not guilty.

-

Detecting Public Equity Fraud

Public equity fraud, which is also known as stock fraud, securities fraud, and investment fraud, is when an individual or business gets people to invest or make purchases based on false information or false promises, which usually means the investor ends up losing their money. Pump-and-dump schemes and trading on insider information are also considered forms of security fraud.

Those investors can hire forensic accountants to prove the fraud took place for a legal case or to try and figure out how they can get some or all of their money back. While it is true that these investors will, at times, make the fraud a legal matter, sometimes they also simply figure out how to get their money back and carry on without making it a bigger problem.

-

Tracing Money

Forensic accountants can trace where money, specifically potentially illegal money, came from. However, if an individual or business does what is called money laundering, the task does become more difficult. Money laundering is when a person or company transfers their money into several (sometimes many) different small accounts. However, forensic accountants with experience with analytical and accounting skills can generally still trace the money through all those accounts and find the original source, proving that the money is illegal (or, in some cases, legal).

Forensic accounts are generally able to trace the money, even if it is not illegal, which can be beneficial to some people for a variety of different reasons.

-

Resolving Family and Marital Disputes

There are two main forms of fraud related to family and marriages. The first is when a person uses their relationship (such as marriage) with another person in order to steal money from them. The other is when people hide money from their spouses or families that they are not legally allowed to hide. Fraud within families or marriages is generally much smaller than fraud committed within businesses and especially big corporations, but it can still result in a lot of financial damage for a person.

Forensic accountants can be hired by individuals to help figure out if there is fraud taking place within their family and marriage and, if so, what the extend of the problem is and whether or not there is a solution.

-

Identifying Bankruptcy and Other Major Business Economic Losses

Fraud does not necessarily have to be taking place in order for a forensic accountant to be useful. Forensic accountants often play an important role in helping a business or person recover from a major economic setback or even bankruptcy.

A forensic accountant can help look at what went wrong, identify if there was any foul play, and help the business or individual develop a new plan going forward in order to avoid more of the same problems. A forensic accountant can also help if an individual or business is being blamed for some sort of major economic setback, and they need to prove that they did everything by the book. As stated previously, sometimes individuals will hire forensic accountants to deal with economic setbacks, but more often than not, it is businesses and corporations hiring forensic accountants for this reason.

-

Finding Hidden or Misappropriated Assets

The misappropriation of assets is a form of theft typically done by an individual or small group against a business or organisation. It can be common theft (which is property theft) or a more complicated type of theft such as embezzlement, payroll fraud, causing a company to pay for goods and services they are not actually receiving, and any other case where an individual or employee uses a businesses funds for their own personal use. On the other hand, hiding assets is when an individual or business leaves certain assets off of a balance sheet in order to hide them from someone else or another entity.

Hiding assets is done for a variety of different reasons depending on who the person or company is hiding the assets from. Forensic accountants can figure out if and how either of those is happening in order to keep companies and the people within those companies accountable.

-

Exposing False Insurance Claims

False insurance claims have been taking place pretty much as long as there has been insurance. When people file a claim, they tend to receive some sort of monetary benefit, so people will file false claims in order to receive that benefit without actually facing the problem. Typically, people will file with claims that are hard to disprove, such as stolen cars, minor car accidents, staged fires, commercial liability fraud, and other forms of theft.

Insurance companies may hire forensic accountants when they are dealing with claims that they are not 100 percent certain are accurate claimed. Forensic accountants are able to carefully analyse and identify the facts related to the claim and make a decision about whether or not the claim is valid. Sometimes, individuals will also hire forensic accountants if an insurance company is claiming that their claim is false when, in reality, it is not.

-

Identifying Terrorism and Counterintelligence

Today, one of the biggest or most common forms of terrorism and counterintelligence revolves around cybersecurity breaches, and one of the major tools we have to combat those threats are forensic accountants. While forensic accountants are most commonly brought in after people are already suspecting that there may be a problem or fraud, they can also be employed to keep watch to make sure that nothing goes unaccounted for or unnoticed.

Forensic accountants will watch money and finances closely so that if a cybersecurity breach begins to take place, they can catch before it has created too much damage or even before it creates any damage. Generally, when forensic accountants are working against terrorism and counterintelligence, they work as one part of a team rather than the sole person on the job.

Final Thoughts

When people think of accounting, they often think of a person sitting behind a desk counting money and crunching numbers, and while that may sound found to the math lovers out there, most people find that to sound rather boring. In reality, there are tons of different interesting things that accountants can do.

Forensic accounting combines accounting with a number of other fascinating fields like detective works and law. They get to work every day to combat fraud, solve some pretty major problems, and some even play a major role in combating terrorism. It is not so boring after all, is it? If you are interested in accounting, perhaps you want to consider forensic accounting as your field of choice.

Related Posts:

- 6 Reasons Why Accounting is the Language of Business

- Is Accounting Hard? 6 Myths and their Realities

- Is Accounting a Good Career | Everything you Need to Know

Disclaimer: Above links are affiliate links and at no additional cost to you. I may earn a commission. Know that I only recommend products, tools, services and learning resources I’ve personally used and believe are genuinely helpful and relevant. It is not because of the small commissions I make if you decide to purchase them. Most of all, I would never advocate for buying something that you can’t afford or that you’re not yet ready to implement.